Covered Bond Market H1 2019 review and outlook

Matthias Melms

NORD/LB

Henning Walten

NORD/LB

07.2019

Juli 2019

While the beginning of 2019 was still dominated by the European Central Bank’s withdrawal from the market, economic development ultimately resulted in the renewed discussion of a return of the monetary authorities and a resumption of purchasing activities. Fundamentally, the past six months were characterised by a comparatively high level of issuance activity. We are taking the end of the second quarter as an opportunity to review the market’s performance and look at the factors that will have a decisive influence on the next six months of 2019.

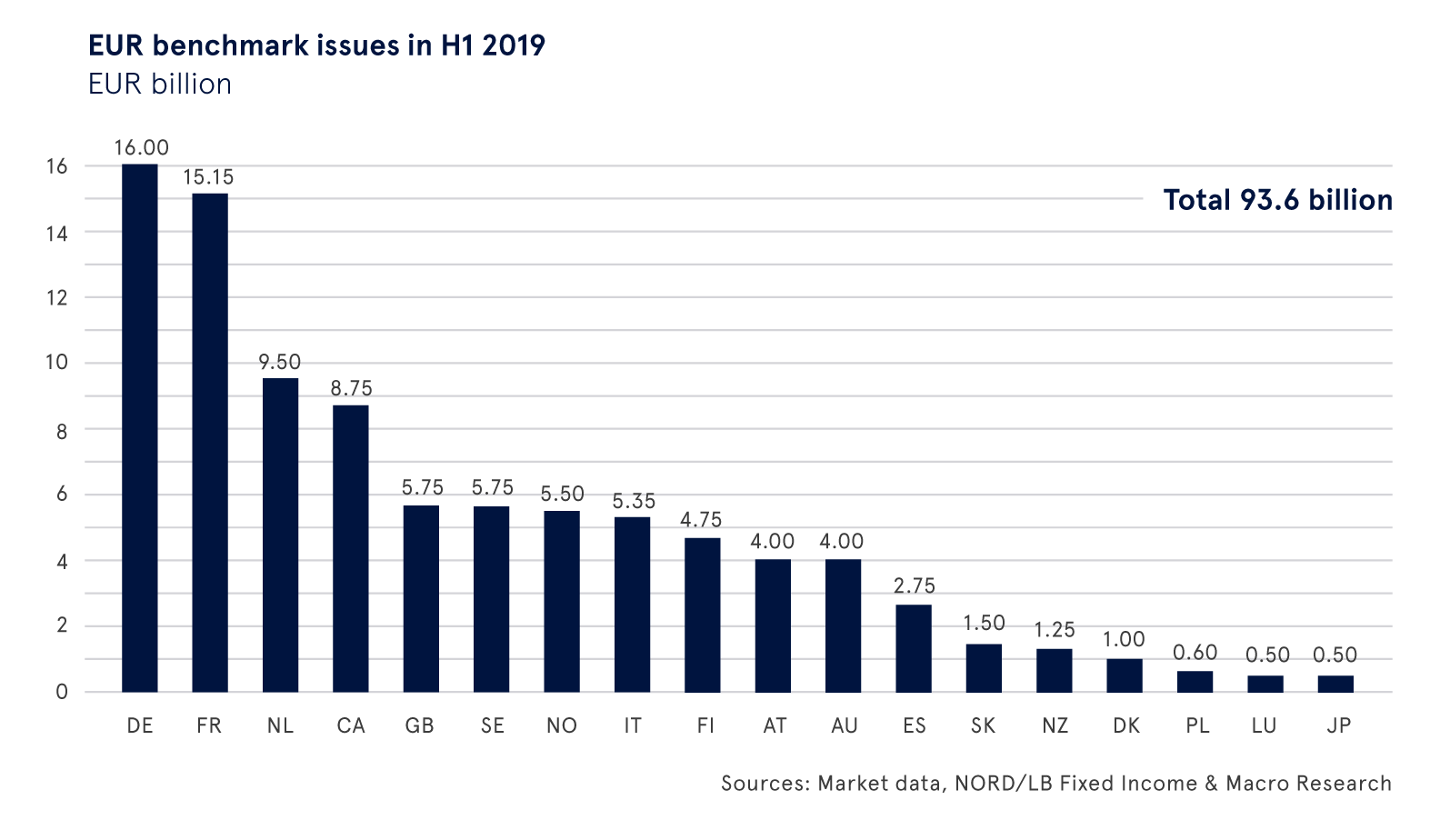

Issues from a total of 20 jurisdictions

A total of 111 bonds with an aggregate volume of EUR 93.6bn were issued in the first six months of the current year in the EUR benchmark bond market. This makes it the most active first half-year of the past 8 years. German issuers were the busiest in this period with 22 deals overall in the EUR benchmark segment. They are followed by banks from France with 15 bonds, 5 more than banks from the Netherlands issued. At the other end of the scale are five jurisdictions with only one EUR benchmark each: Japan, South Korea, Luxembourg, Poland and Portugal. Looking at the volume issued, it is unsurprising that the top 3 are in the same order. However, it should be noted that despite a smaller number of bonds, the issuance volume from France of EUR 15.15bn is only marginally lower than that from Germany (EUR 16.0bn). Dutch issuers placed bonds with a volume of EUR 9.5bn. Outside the Eurozone, Canadian issuers were the most active (7 deals with a volume of EUR 8.75bn).

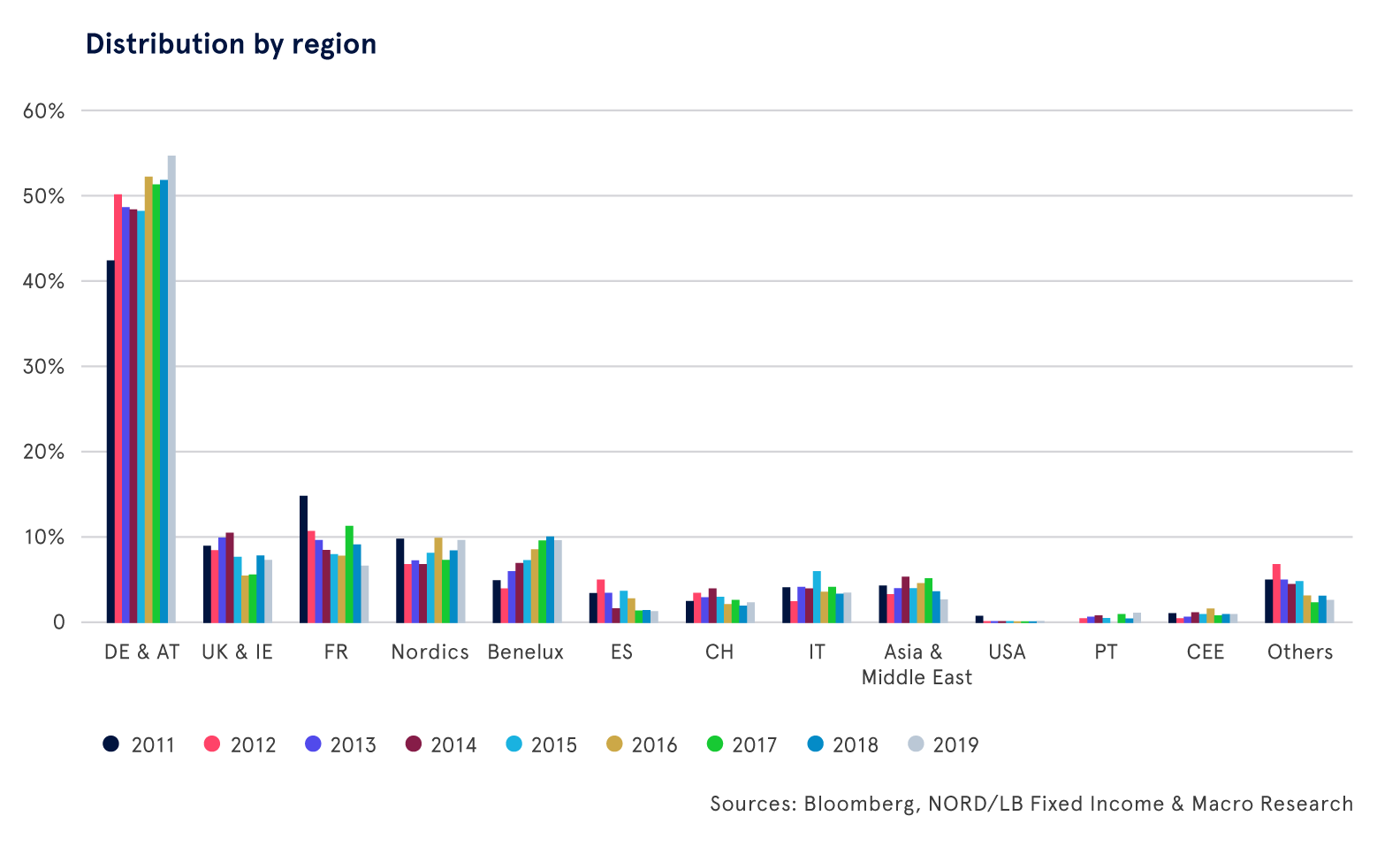

Historical high for DACH region

The DACH region (Germany, Austria and Switzerland), and Germany in particular, accounts for around 57 % of EUR benchmark bond issues, making it the most important region in terms of covered bond investors. This figure is also the region’s highest share for the past eight years. The participation of investors from Germany, Austria and Switzerland in new issues was around 3.5 percentage points higher than in the previous year. In contrast, the reverse was true for investors from UK/Ireland and France. Here, the percentage shares for the first half of the year were down by 0.5 and around 3.0 percentage points respectively versus 2018 as a whole. These developments also affect the relevance of individual jurisdictions/regions with regard to investors. While the DACH region continues to account for the largest share of new issues, second and third place in 2019 were taken by the Nordic and Benelux regions with around 9.5 % each. This year, French investors (6.5 %) only managed fifth place after UK/Ireland (7.1 %), compared with their third-place ranking (9.0 %) in 2018.

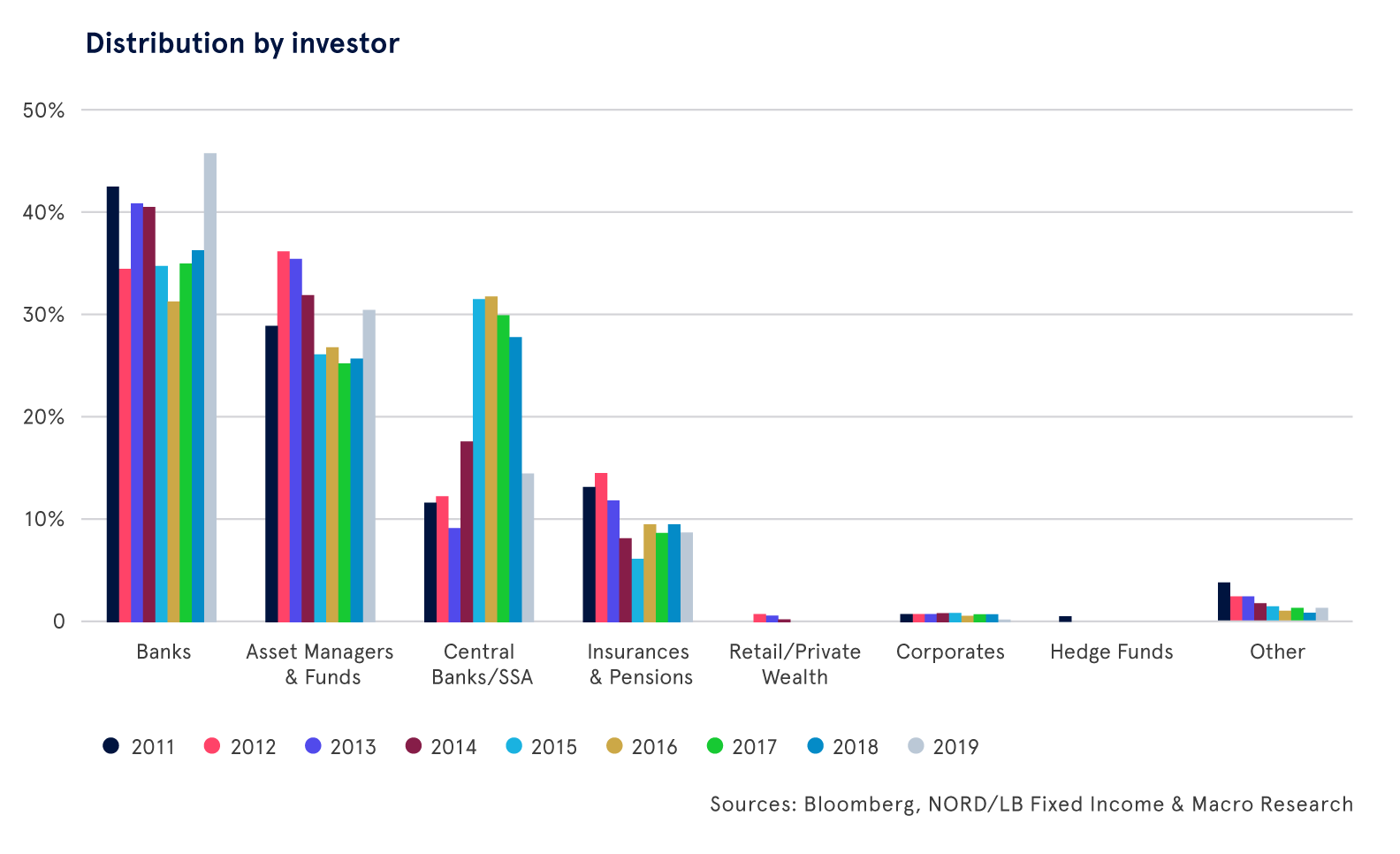

Banks and asset managers & funds absorb reduced demand from ECB

A closer analysis of the investor groups participating in benchmark bonds reveals that the share attributable to central banks/OI has reduced by around half (from 28 % to 14 %), which should come as no surprise given the ECB’s self-imposed rule of only reinvesting funds from maturing bonds under CBPP3. This declining demand from the Eurosystem has been absorbed on the one hand by banks, with the share here up from 36.0 % (2018) to 45.6 %, and, on the other, by asset managers & funds (rise of five percentage points to around 30 %). While the allocation to banks is therefore at its highest level for the past few years, the share accounted for by asset managers & funds is on a par with the level seen in 2014 and 2011. In fourth place after banks, central banks and asset managers & funds, insurance companies & pension funds continue to be an important investor group for covered bonds, especially for long-dated deals, and account for a slightly smaller share than in 2018.

Notable events in covered bond market

Other notable events in the first half of the year include the sub-benchmark debut by Slovakia’s Tatra Banka, which followed on the heels of the inaugural bonds issued by VUB and Slovenska Sporitelna, although the latter two deals were in benchmark format. Positive news also came from the market for sustainable bonds with a social covered bond debut from CAFFIL and the first green covered bond issued by Poland’s PKO Bank Hipoteczny. Another highlight came from Korea’s KHFC and Japan’s SMBC, which were active in the market again with a EUR benchmark following their debuts in October 2018. Given the current interest rate and spread environments, at this juncture we should also mention the penultimate issue of the first half of the year. The 5-year EUR 750m bond issued by Helaba (HESLAN 0 07/03/24) was placed in the market at ms -2bp. Combined with the current swap curve, this results in an issue yield of -0.227 %.

European covered bond market harmonisation

On 18 April 2019, the content of the legislative package to harmonise the European covered bond market was approved. However, as the relevant texts were not yet available in all the official languages at the time of the vote, it was already clear at that stage that there has to be another Parliament’s approval. This has been delayed however; first because of the European elections and now due to parliament’s summer recess. The implementation period for transposition of the requirements into national law, which comprises 18 months followed by a further period of 12 months, will not start until final approval has been received. Compliance with the requirements under the directive and regulation will only be binding once this period has ended. At the moment, we assume that the process will not start until Q4 2019.

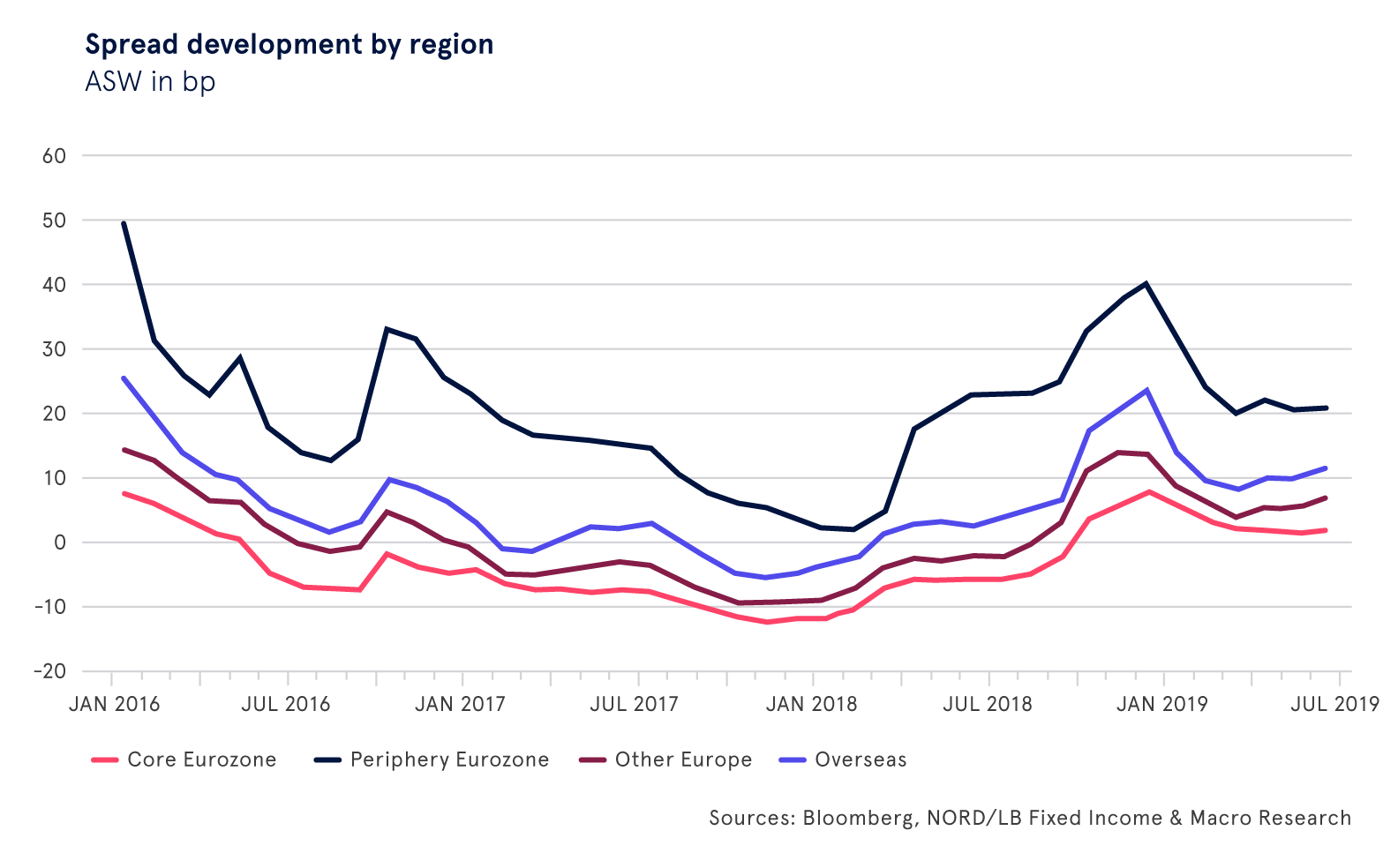

Movement in spreads in first half of year

The announcement of the ECB’s withdrawal from the market at the end of last year was accompanied by significant spread widening, which peaked temporarily in January 2019. This was also due to the fact that at the start of this year covered bonds were attractively priced from a relative value perspective, especially versus SSAs and sovereigns. Slightly negative net supply in the market then led to a substantial spread tightening of around 7 basis points in the Core Eurozone and Other Europe regions. Spreads in the Overseas region have tightened by around 13 basis points since the end of January, while Periphery Eurozone saw the biggest change in spreads at 19 basis points, although this is due to the high starting level.

Spread outlook for the coming months

While spread tightening in the first half of the year was primarily characterised by (i) the relative attractiveness of covered bonds in the rates universe versus sovereigns and SSAs and (ii) dwindling positive net supply, which has been in negative territory since February in particular, the starting situation for the second half of the year is less supportive for covered bond spreads. Covered bonds have meanwhile become considerably more expensive versus sovereigns and SSAs. In short and medium maturities especially, we consider sovereigns and SSAs to be relatively more attractive than covered bonds. In the seven and ten year segments, the picture is more differentiated. Although covered bonds are no longer attractive, they do not appear overly expansive and we consider the valuation here to be fair. For the second half of the year, we expect net supply to be balanced overall and therefore do not believe it will deliver any notable impetus for spreads. On the whole, we expect slightly weaker spreads for the second half of the year as covered bonds are no longer attractive versus other rates products. Any emerging speculative hopes of securities buying, especially with regard to ECB meetings after the summer recess, are set to be more than offset by the prospect of a significantly larger primary market supply, particularly in the first half of 2020.

Issuance volume of up to EUR 130bn expected

The axiom for the forecast issuance volume for 2019 was another tender programme from the European Central Bank whereby the pricing would also be attractive enough for covered bond issuers that at least some would choose the tender over bond issues. Given that the pricing is not so advantageous in our opinion, we currently envisage a scenario where the issuance volume outstrips our projection of EUR 121bn. While we have forecast a positive net supply of EUR 20bn for the year as a whole, the figure already stands at EUR 28bn in the first six months, mainly because of the high level of issuance activity in January. With an issuance volume of EUR 37.25bn, net supply amounted to EUR 24bn. Bonds with a volume of EUR 39bn will mature in the second half of the year, which should lead to an issuance volume of roughly the same amount. We therefore expect the volume to slightly exceed our forecast at EUR 125bn to EUR 130bn.

Conclusion

While the spread environment at the beginning of the year was initially characterised by the ECB’s decision to only reinvest funds from maturing bonds under the CBPP3, spreads tightened considerably after the wave of new bond issues in January. Overall, we are anticipating slightly weaker spreads in the second half of the year, as covered bonds are no longer attractive in comparison with other rates products. Emerging purchase fantasies, particularly with regard to ECB meetings following the summer recess, should however be more than compensated for on the back of the prospect of significantly higher primary market supply, above all during the first six months of 2020. In addition to the growing number of issuers and jurisdictions, the steady influx in the sustainable bond segment is another reason for the fundamentally positive assessment of the first half of the year. These aspects are set to become a growing focus for investors in the future and consequently for issuers as well. Going forward, further progress in endeavours to harmonise the European covered bond market is set to represent an important milestone for the market as a whole, while the generous implementation and transition phase should mean that there will be no market distortions. The direction the ECB takes will continue to be decisive for the market as a whole in the second half of the year, particularly with regard to a potential resumption of net purchasing.