Covered bond purchase programs have been part of the European covered bond market for many years. The first purchase program (CBPP1) was launched in 2009, followed by CBPP2 in 2011 and CBPP3 in 2014. While the first two programs ran for about one year each, the third program is still in place and has been adjusted several times: net-purchase phase from October 2014 to December 2018, reinvestment phase from January to October 2019, new net-purchase phase since November 2019 (CBPP3.1) and a temporary additional increase from March 2020 until year-end. Reacting to the COVID-19 crisis, an additional asset purchase program, the Pandemic Emergency Purchase Program (PEPP), was announced. Besides the asset purchase programs, monetary policy measures like the TLTRO and the Pandemic Emergency LTRO (PELTRO) were introduced. We take a closer look at the impact and consequences of the ECB instruments that affect covered bonds directly and most strongly.

The measures

Targeted longer-term refinancing operations (TLTRO):

The TLTROs are Eurosystem operations that provide longer-term funding to credit institutions under attractive conditions to stimulate bank lending to the real economy. At its last two meetings, the ECB announced several improvements in conditions of the TLTRO III:

- It increased the amount available for banks from 30% to 50% of their stock of eligible loans;

- it removed the limit of 10% of the stock of eligible loans for the amount of funds that can be borrowed in each operation so banks can, in principle, bid for all of their allowance in June 2020;

- the lending performance threshold that needs to be met in the period from 1 March 2020 to 31 March 2021 in order to pay the minimum rate has been cut from 2.5% to 0%;

- it introduced the possibility to repay funds early and thus flexibility and finally,

- it has significantly reduced the costs. Banks will pay the depo-rate minus 50bp if they achieve positive lending in the period 1 March 2020 to 31 March 2021 and MRO minus 50bp otherwise.

These conditions will apply in the period June 2020 to June 2021. At the end of April 2020, the ECB introduced a new liquidity facility, pandemic emergency LTRO or PELTRO, which consists of a series of non-targeted pandemic emergency longer-term refinancing operations carried out with an interest rate that is 25bp below the refi-rate.

What does this mean for covered bonds?

We view two measures implemented by the ECB, namely the purchase programs and the TLTRO III, as most relevant for covered bonds.

1. The purchase programs CBPP3 & PEPP:

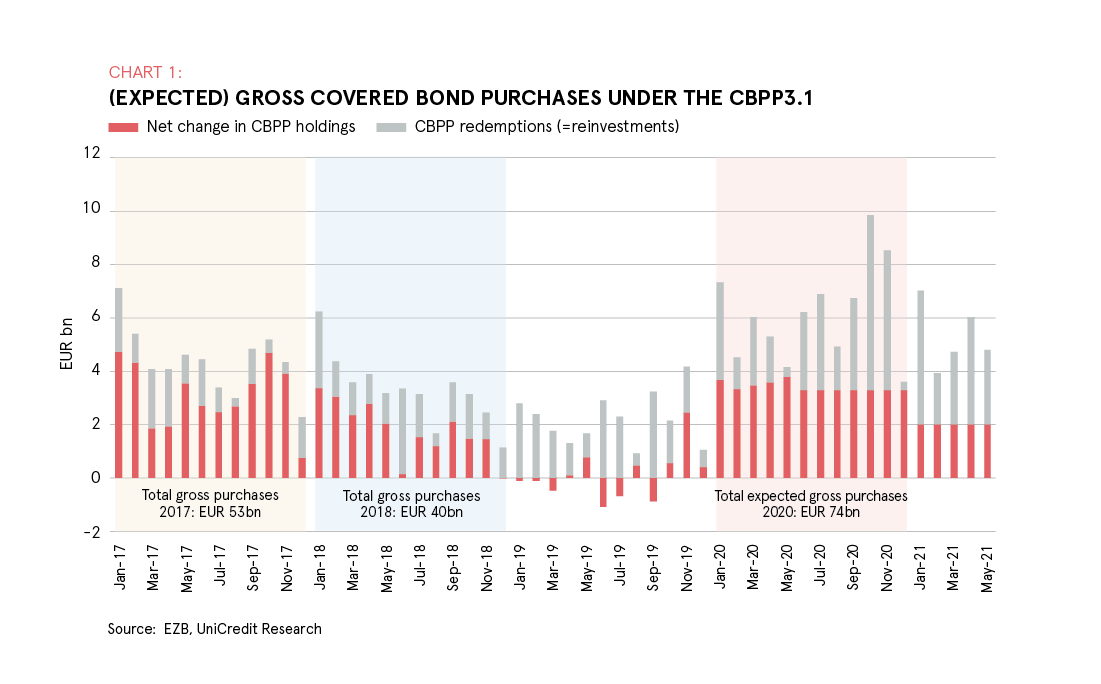

Assuming a similar composition in terms of asset classes to that of previous programs, the share of covered bonds purchased under CBPP3.1 would be around 10%, which has been broadly confirmed by reported historic figures (covered bond holdings of EUR 281.5bn versus APP holdings of EUR 2.74tn as of end-May 2020). In addition to the ordinary monthly purchases of EUR 20bn, a temporary increase by EUR 120bn until year-end (or around EUR 13.3bn per month has been introduced). Thus, our calculation of covered bond purchases for 2020 is as follows: APP purchases of EUR 33bn per month between March 2020 until year end; of this, around 10% will be covered bonds. This is equivalent to EUR 3.3bn of covered bond purchases. On top of this, monthly covered bond reinvestments in 2020 amount to EUR 2.8bn on average, which brings the total amount of covered bond purchases per month to around EUR 6bn. For 2020, this adds up to EUR 74bn. To put this into perspective, annual gross benchmark covered bond supply in 2018 and 2019 was around EUR 140bn, of which roughly EUR 100bn was eligible eurozone covered bonds (for 2020, the annual supply is expected to be significantly below previous years’ amounts). Thus, the ECB would need to buy as much as three quarters of new gross supply in order to meet its targeted purchasing volumes. This calculation leaves aside that some covered bonds issued in previous years could be purchased in the secondary market. However, we regard this amount to be of minor importance as covered bonds are typically a buy-and-hold asset class and markets have already been affected in the past few years by ECB demand.

The chart shows reported net changes in covered bond holdings between January 2017 and May 2020, as well as our estimated net purchases from June 2020 onwards. The grey columns show reported redemptions up to May 2021. As mentioned above, the sum of net purchases in 2020 and the amount of covered bond redemptions reinvested amount to roughly EUR 74bn. Depending on the expected supply in 2020, the share of covered bonds purchased by the Eurosystem could be a dominant part of annual eligible supply.

PEPP:

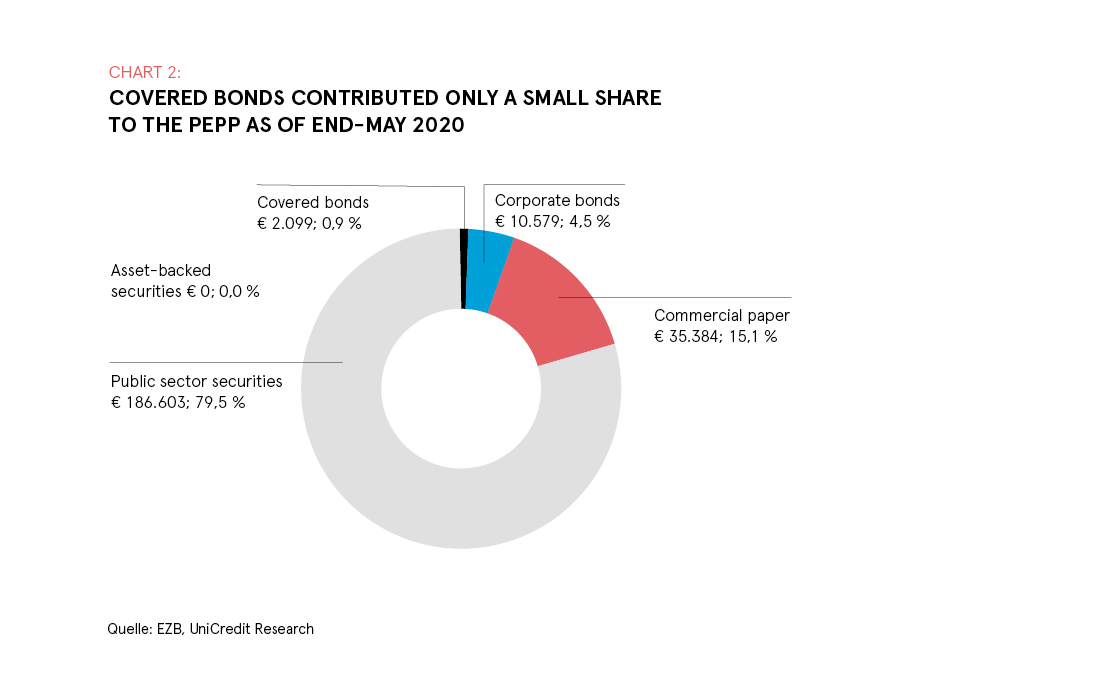

While the overall volume of the program is huge at EUR 1,350bn, the first reporting on purchases revealed for covered bonds that between March and May 2020, only EUR 2.1bn was bought. This is only 0.9% of total purchases of EUR 235bn. The key asset class purchased involved public sector securities (see chart). Thus, at current levels, the PEPP does not have a significant impact on covered bonds.

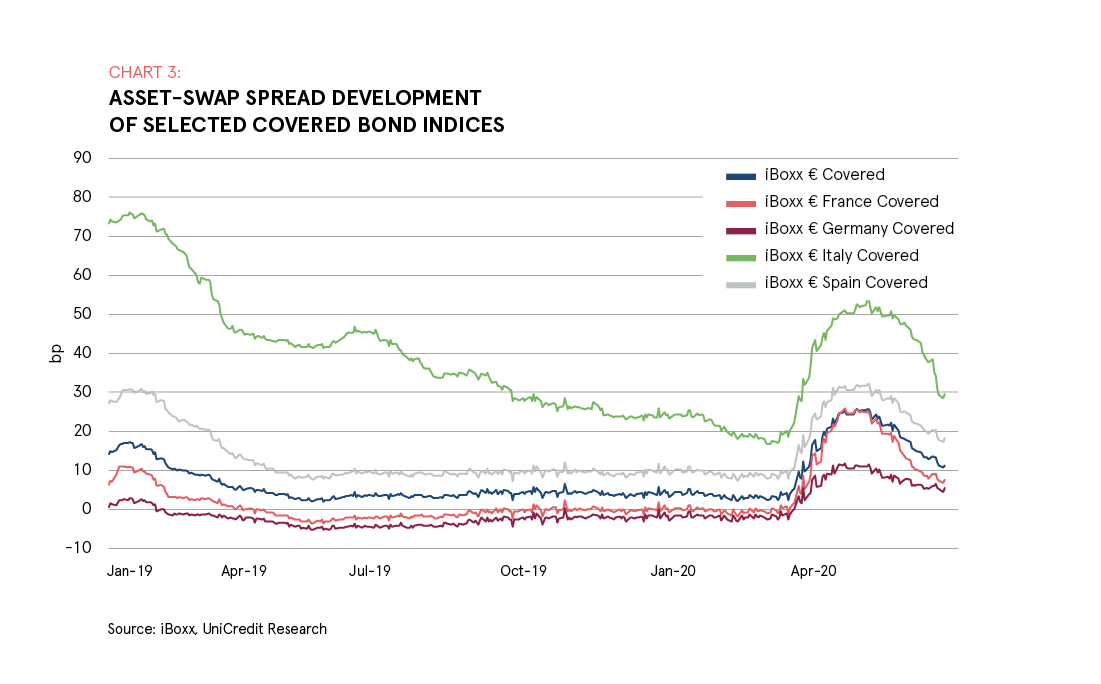

Overall, the purchases of covered bonds under the Eurosystem’s asset purchase programs have reduced liquidity in the covered bond market. However, the participation of the ECB in the primary market is positive with respect to any potential execution risk when placing bonds, and demand from the ECB in secondary markets has had a significantly positive effect on asset-swap spreads of covered bonds in recent months (see chart below). So far in 2020, the split between primary market purchases and secondary market purchases was almost 40% in the primary market and 60% in the secondary market. We expect spread levels in 2H20 to continue to benefit from this development.

2. TLTRO III.4:

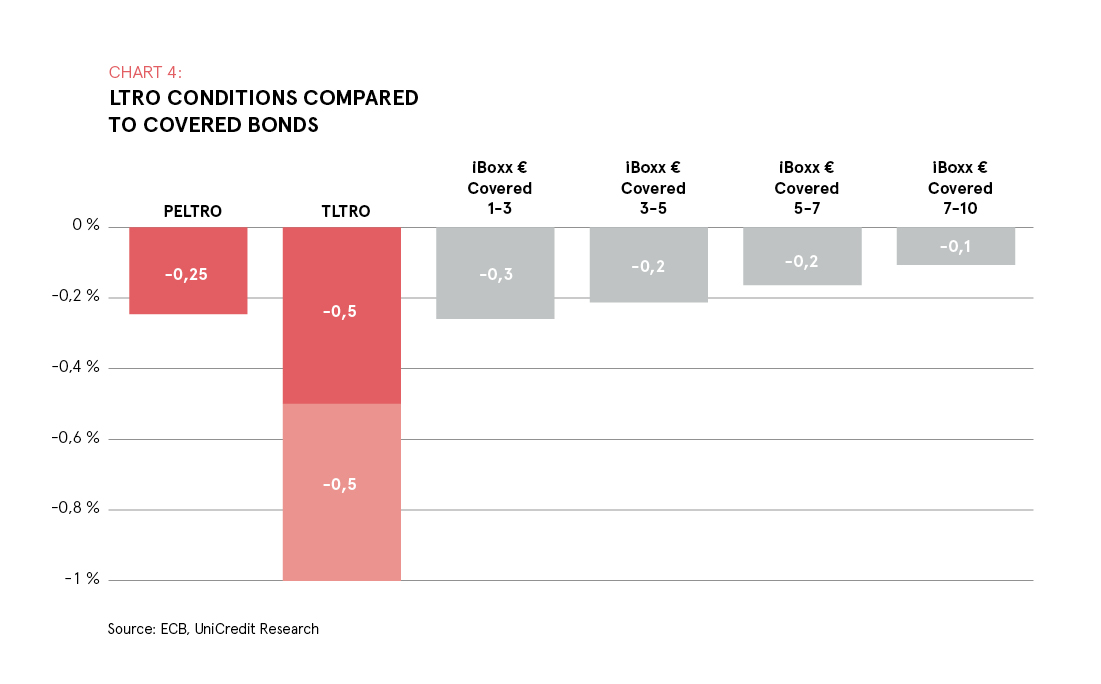

On 18 June 2020, the ECB reported that under the TLTRO III.4 a volume of EUR 1.31tn from 742 participating banks was allotted. This was the first long-term refinancing operation that was carried out under the improved funding conditions that were announced by the ECB at its 30 April meeting. The operation will mature in June 2023, but banks will have the option to repay funds early on September 2021. Until June 2021, the funding cost can be as low as -1.0%, while the less favorable rate will be -0.5%, the same level as the ECB depo rate. Given the highly attractive conditions, it is understandable that the amount taken-up by banks was very large and the number of banks significant. Under the TLTRO III.4, banks can benefit from conditions that are significantly more favorable than current covered bond funding levels. On average, the iBoxx EUR Covered 1-3Y index has a yield of -0.3% and the iBoxx EUR Covered 3-5Y has a yield of -0.2% (see chart below).

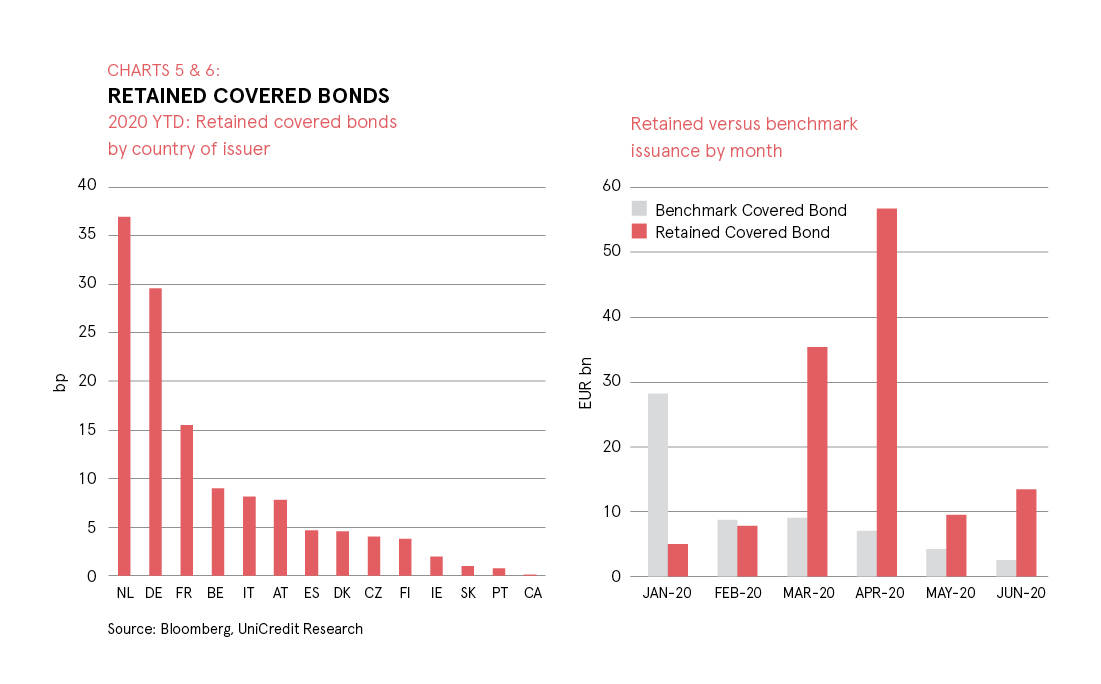

An important consequence for covered bonds resulting from the attractive TLTRO conditions is the strong decline of publicly placed covered bonds. Banks decided to issue retained covered bonds in order to use them as collateral for refinancing operations rather than to publicly place them with investors. Thus, the volume of retained covered bonds has significantly increased in 2020, with EUR 128bn issued between the beginning of the year until mid-June. These large volumes are only comparable to levels seen in 2011/2012. In contrast to the past, the highest volumes were generated by banks from markets like the Netherlands, Germany or France and not from countries like Spain or Italy. The higher volumes in retained covered bonds have clearly weighed on the amount of covered bonds publicly placed with investors (see charts below).

However, in the same week in which the EUR 1.31tn take-up under the TLTRO program was published, we have seen positive momentum returning to the covered bond primary market. Six covered bonds with an aggregated volume of EUR 4.75bn have been publicly placed and met strong investor demand. This was significantly more activity than we have seen in the previous weeks during May and April. This indicates that banks continue to appreciate covered bonds as an attractive funding tool despite highly attractive TLTRO conditions. This is driven by many factors, among them the longer achievable duration with covered bonds and the preservation of continuous access to real-money investors. Thus, we expect covered bond supply to hold up in the coming months, although at levels below those of previous years.