September 2018

On 6 July, the Upper House of the German Parliament (Bundesrat) gave the green light for an amendment to the German Banking Act (KWG) by waiving its right of veto under the “Act on the Exercise of Options under the EU Prospectus Regulation and the Adaptation of Other Financial Market Laws”. Section 46f KWG and hence the regulations governing the liability cascade for banks are now in line with European law. As a result, since 21 July 2018, German banks have been able to issue senior preferred ‘vanilla’ bonds as well as senior non-preferred (senior bail-in) bonds.

In this document, we will examine the two types of securities, focusing on selected features, and consider whether German senior preferred bonds can be regarded as a rival product to German Pfandbriefe.

Product characteristics and regulatory comparison

Senior preferred bonds

Senior preferred bonds are designed to provide German banks with a cheaper funding option compared to the existing unsecured bonds. Unlike the unsecured bonds issued up to now, the new segment cannot be used to meet regulatory minimum requirements such as MREL (Minimum Requirement for own Funds and Eligible Liabilities) or TLAC (Total Loss Absorbing Capacity).

After the insolvency sequence for banks in Germany was modified, as mentioned above, all currently outstanding senior bonds of German banks were subordinated to the new senior preferred bonds.

This means that old holdings of outstanding senior bonds of German banks were placed on an equal footing with future senior non-preferred issues from a regulatory perspective. As a result, there is minimal backlog demand for the issuance of senior non-preferred bonds among the major German institutions to meet regulatory minimum requirements.

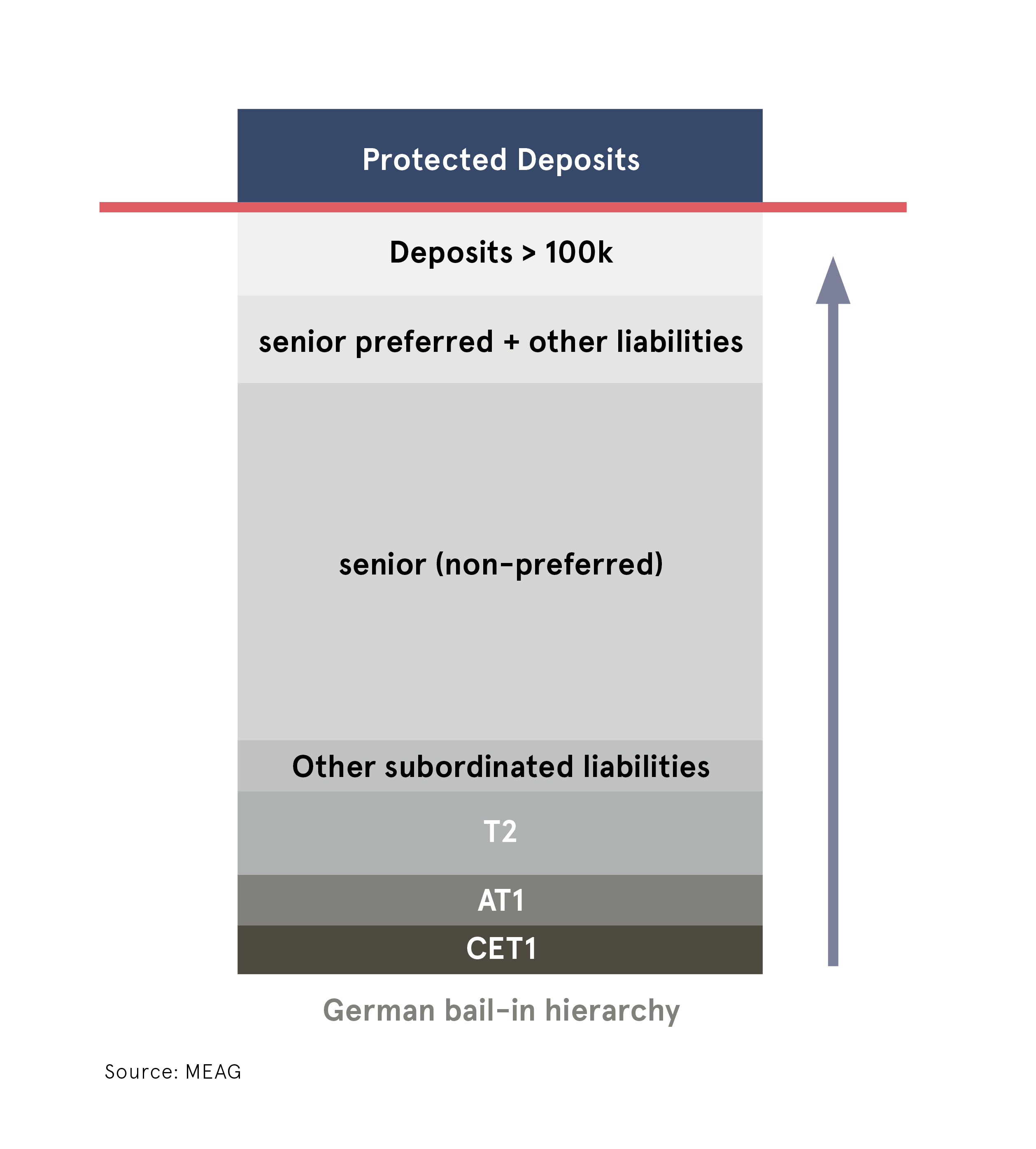

Senior preferred bonds offer greater protection than senior non-preferred bonds, as senior non-preferred bonds are held expressly for the purpose of bail-in, and in this case serve as a buffer for senior preferred bonds. (see chart)

Pfandbriefe

The Pfandbrief is one of the largest segments of the European bond market. It has frequently shown itself to be a reliable funding instrument for banks and a safe investment, especially in times of crisis. Pfandbriefe give investors a degree of security comparable to that offered by only a small number of especially highly rated sovereign issuers. Their high creditworthiness is also reflected in the top-class ratings assigned by rating agencies.

Unlike senior preferred bonds, the regulator exempts Pfandbriefe from bail-in mechanisms. In addition, Pfandbrief investors are protected by the provisions of the German Pfandbrief Act (Pfandbriefgesetz), which has been steadily improved over the years. Furthermore, Pfandbriefe are subject to special public supervision by the Federal Financial Supervisory Authority (BaFin).

Rating

Senior preferred bonds

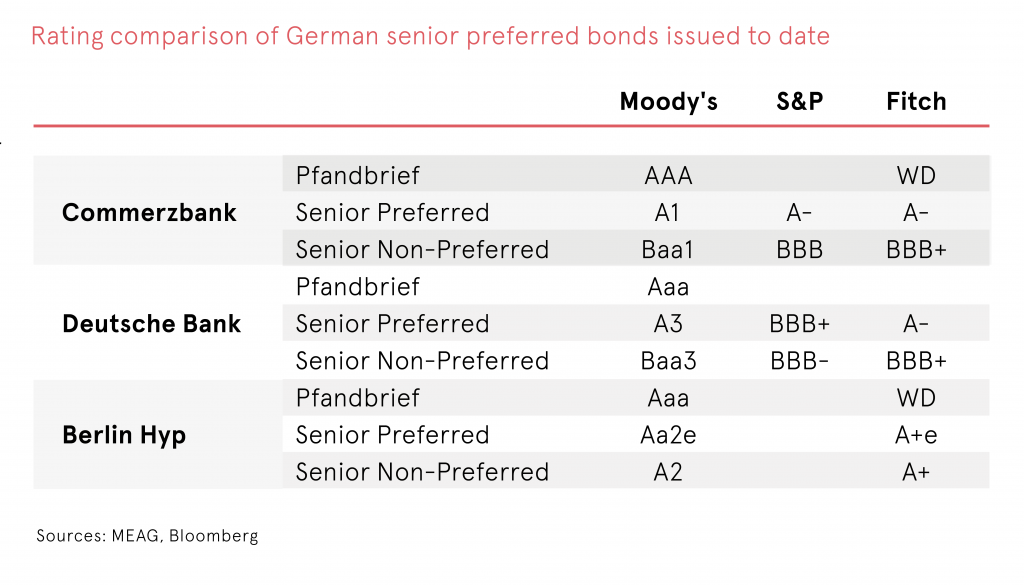

Depending on the structure and volume of the issuer’s outstanding bonds and capital cover, the rating agencies give senior preferred bonds a rating that is in some cases considerably better than that of senior non-preferred bonds. In the case of Commerzbank, which was the first issuer to issue a German senior preferred bond in benchmark format, the rating is three notches higher at Moody’s, two notches at S&P and one notch at Fitch. This is due in particular to the bail-in buffer mentioned above, given the volume of outstanding old senior bonds. Commerzbank’s Pfandbriefe are only rated by Moody’s, which assigns the highest score of triple-A.

This puts the Pfandbrief rating 7 notches above that of senior bail-in bonds and 4 notches above that of senior preferred bonds.

It is a similar picture for the other two outstanding senior preferred bonds issued by Deutsche Bank and Berliner Hypothekenbank.

Pfandbriefe

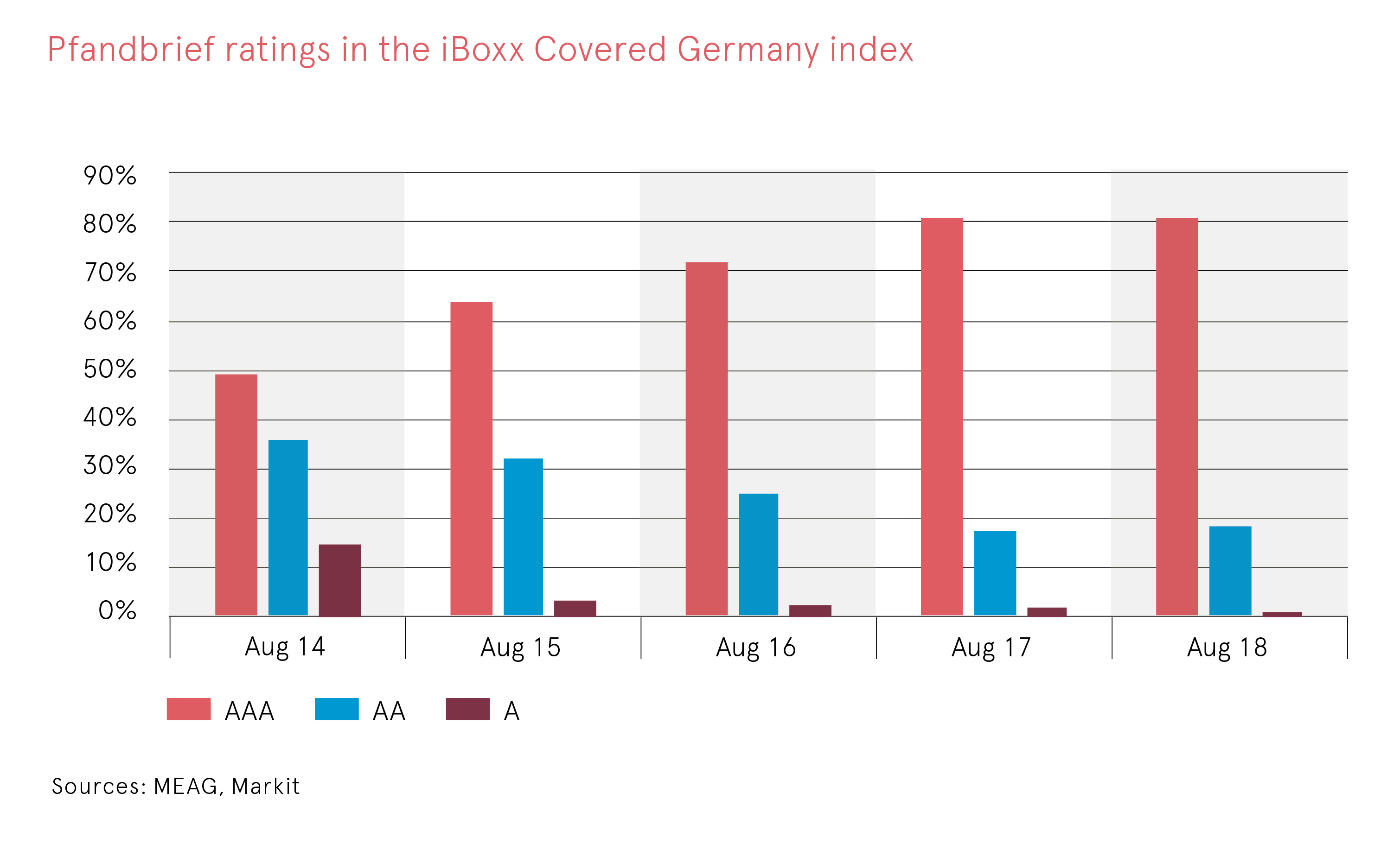

The ratings assigned by the agencies to German Pfandbriefe have improved steadily over the past five years. Based on the ratings in the iBoxx Covered Germany index, over 80 % of the outstanding Pfandbriefe had a triple-A rating as of the end of July. By comparison, at the end of July 2014 just under 50 % of German Pfandbriefe were rated triple-A.

This high proportion of triple-A rated Pfandbriefe underlines the high quality standards that distinguish this product and are appreciated by investors.

Pfandbrief ratings in the iBoxx Covered Germany index.

Yields / spreads

Senior preferred bonds

Regulatory authorities have expressly required German banks to provide sufficient MREL/TLAC instruments to deal with situations requiring regulatory intervention. However, senior preferred bonds are not generally counted towards MREL or TLAC quotas. Even if they can be used in the event of a bail-in in principle, they are not primarily intended for this purpose. This leads us to believe that there is keen interest from a regulatory perspective in carrying out necessary regulatory measures before the capital base is so low that even senior preferred bonds would be subject to bail-in. The future spreads of senior preferred bonds should therefore – depending on the quality of the issuer – be roughly midway between the levels of the – very safe – Pfandbriefe and those of the old seniors or new senior non-preferred bonds. “Fully filled” senior non-preferred segments are of course a basic prerequisite for tighter spreads of senior preferred bonds, in accordance with regulatory requirements.

In the future, though, it will be important to keep an eye on how far issuing activity changes the ratio of outstanding volumes of senior (non-preferred) to senior preferred bonds. If the senior (non-preferred) segment shrinks by comparison due to relatively smaller issuance volumes, the quality of senior preferred bonds could suffer due to a smaller buffer in the event of bail-in. This would increase the likelihood of investors being asked to pay up in a bail-in scenario.

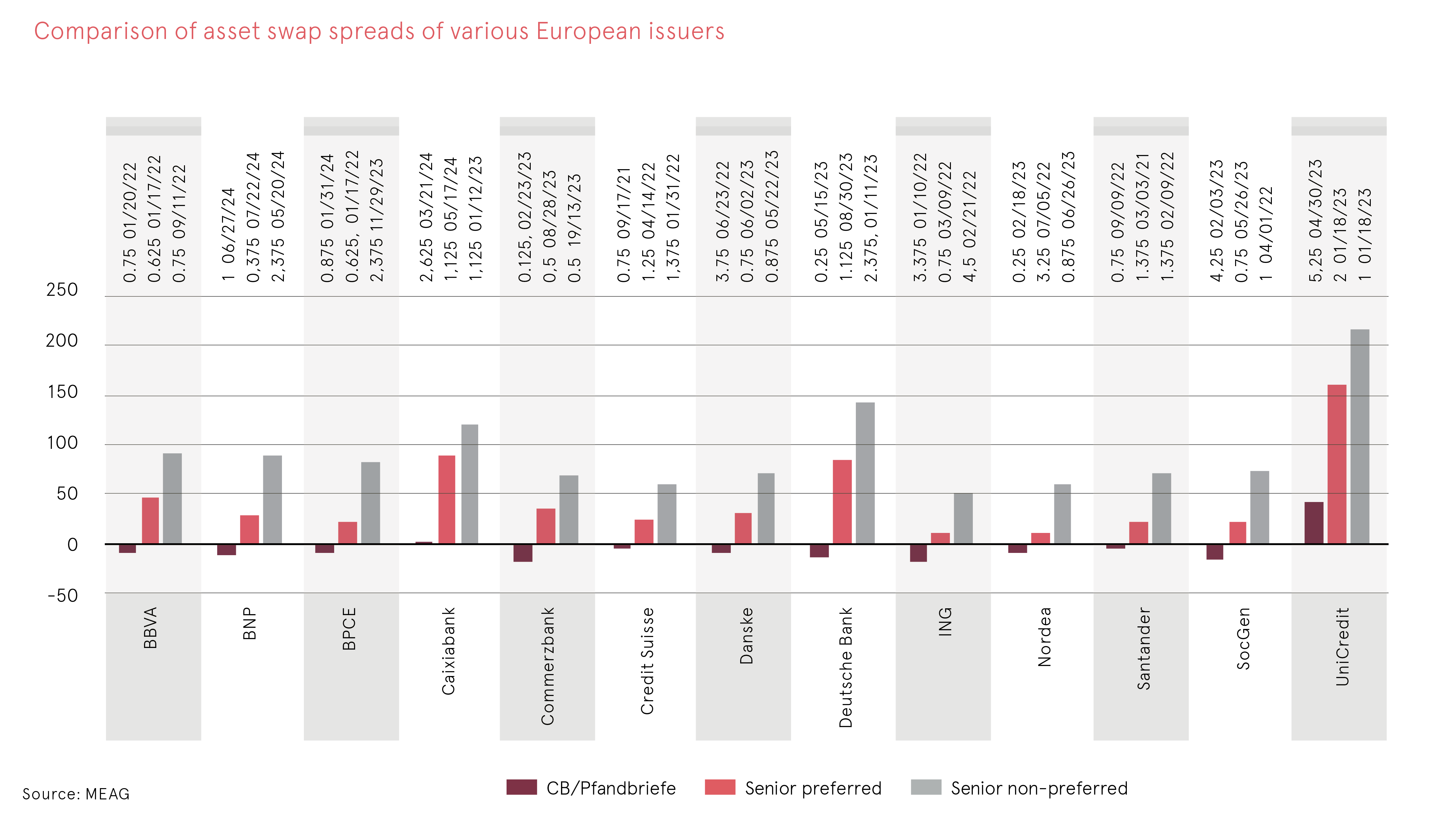

In the case of the five-year Commerzbank bond, the issuance level of the senior preferred bond was 35 basis points (bp). The gap with the comparable senior non-preferred bond was thus approximately 33 bp. The gap with the comparable Pfandbrief was around 48 bp. We assume that the gap with Pfandbriefe should narrow somewhat in the long term, even if the new issue initially showed somewhat negative price momentum.

The chart below illustrates the described relationships. It shows European issuers that have covered bonds or Pfandbriefe, as well as senior non-preferred and senior preferred bonds, outstanding in benchmark format. Depending on issuer risk and capital structure, the spreads of senior preferred bonds are narrower or wider than mid-way between covered bonds or Pfandbriefe and senior non-preferred bonds.

Pfandbriefe

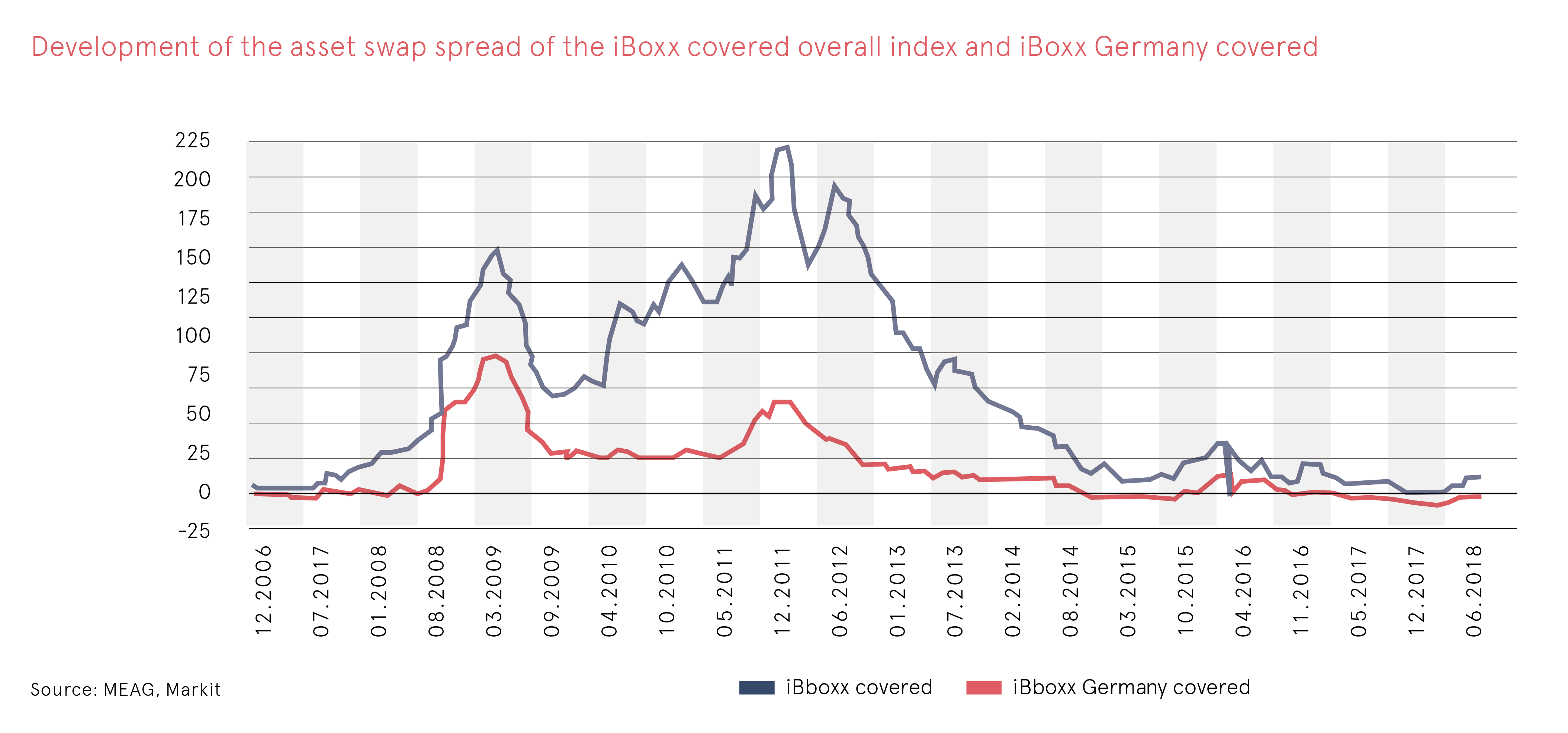

The high proportion of top-rated Pfandbriefe mentioned earlier is also reflected in the trend of asset swap spreads of German Pfandbriefe The following chart shows that, while even Pfandbriefe were not entirely immune to the major crises of the past ten to fifteen years, their spreads have widened by much less than the covered bond index as a whole. Asset swap spreads have even reverted to tighter bandwidths than those seen before the financial crisis. However, this movement is also attributable in large part to the purchases made by the European Central Bank under its third asset purchase programme.

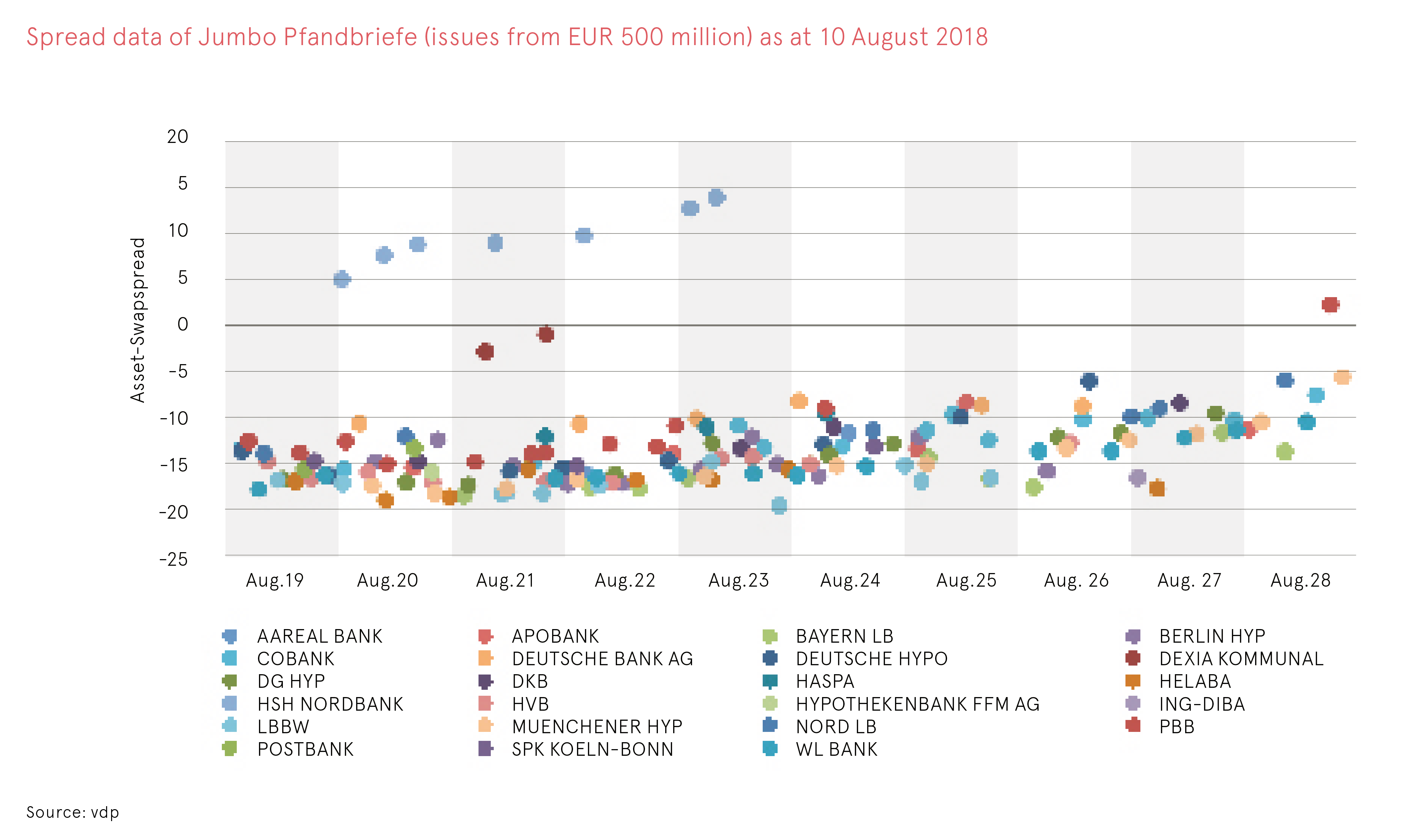

Looking at Jumbo Pfandbrief spreads, it is noticeable that, with one exception, all issuers are trading in a narrow band of around ten basis points in the 1-5 year segment. In the 5-10 year segment, the range increases slightly, but still lies within a narrow band.

Liquidity

Senior preferred bonds

As senior preferred bonds are not used to meet minimum regulatory requirements, the share of these bonds in banks’ total outstanding issuance volume will tend to be somewhat lower. Furthermore, this new segment tends to be aimed at “steady hands”: real money investors such as insurance companies, bank treasuries and retail customers are not generally characterised by a high turnover rate. This suggests lower liquidity and lower price volatility. Observations from other countries such as France, where senior non-preferred bonds have already been introduced, support this argument.

Pfandbriefe

In September 2014, the European Central Bank (ECB) announced a third covered bond purchase programme (CBPP3). Since October 2014, it has been buying covered bank bonds week after week on the primary and second-ary markets. As of 13 August, covered bond holdings in the ECB’s CBPP3 portfolio amounted to EUR 256.66 billion. This is in addition to holdings under the two completed purchase programmes CBPP1 (EUR 4.49 billion) and CBPP2 (EUR 4.04 billion). The total figure of EUR 265.19 billion in the ECB’s CBPP portfolio corresponds to around 40% of the CBPP-eligible covered bonds in the iBoxx covered index and around 31 % of the total iBoxx covered index.

These figures clearly show that the volume of covered bonds, and thus also Pfandbriefe, available to private investors on the secondary market within the euro zone has declined sharply. Also bearing in mind the ECB’s announcement that it will hold its bond positions accumulated under the CBPPs until maturity and reinvest maturities, it is clear that liquidity in the market for covered bonds and thus also for German Pfandbriefe has dete-riorated significantly, though it is still fairly good compared to many other asset classes.

Conclusion

The new senior preferred bonds should not be seen as a direct competitor to German Pfandbriefe. Traditional Pfandbrief investors appreciate the high security of their product, which almost gives it the character of a safe government bond. In our view, the consistently higher ratings of Pfandbriefe compared to senior preferred bonds are a distinguishing feature arguing in favour of the Pfandbrief.

Moreover, the slightly higher yield of German senior preferred bonds compared to Pfandbriefe is not a good enough reason for us to switch to an unsecured investment. If we invest in unsecured bank bonds, these should preferably be bonds that stand below senior preferred bonds in the liability cascade in order to achieve more attractive returns. However, any such investment must be justified by the result of our extensive internal investment and analysis processes. This means that, if we want to invest in safe bonds, we should also buy products that are genuinely safe, such as German Pfandbriefe. If we decide to invest in unsecured bonds, we currently tend to invest lower down the capital structure of banks in order to achieve a higher yield premium, provided we assess the issuer risk as adequate.

Another reason why we do not regard senior preferred bonds as a rival product to Pfandbriefe is the secondary market liquidity mentioned earlier. Admittedly, the liquidity of Pfandbriefe has also deteriorated significantly compared to the heyday of the Jumbo Pfandbrief, with market making within fixed bid-ask spreads in the wake of CBPP3. However, in a direct comparison with senior preferred bonds, the liquidity of Pfandbriefe is clearly superior.

Although senior preferred bonds are not currently a core investment for us, we nevertheless expect plenty of capital market interest in this product. Looking at other countries, senior preferred bonds certainly seem to have a stronger influence on covered bonds compared to what we have observed in relation to Pfandbriefe. For example, the recently issued senior preferred bond of Intesa in Italy has created significant selling pressure for Italian covered bonds. In Germany, issues of senior preferred bonds have not so far coincided with increased sales of Pfandbriefe.

We regard German senior preferred bonds as another investment option, but not as a rival product to existing asset classes. Not least for this reason, we expect a fairly modest supply of senior preferred issues, at least in Germany. For banks, while these bonds are another funding instrument, they do not provide any further regulatory added value. In terms of volume, benchmark Pfandbriefe worth just under EUR 20 billion had already been issued by the end of July 2018 – more than in the whole of 2017. This means that demand for Pfandbriefe remains very high, despite low yields and tight spreads. Good quality remains sought after.