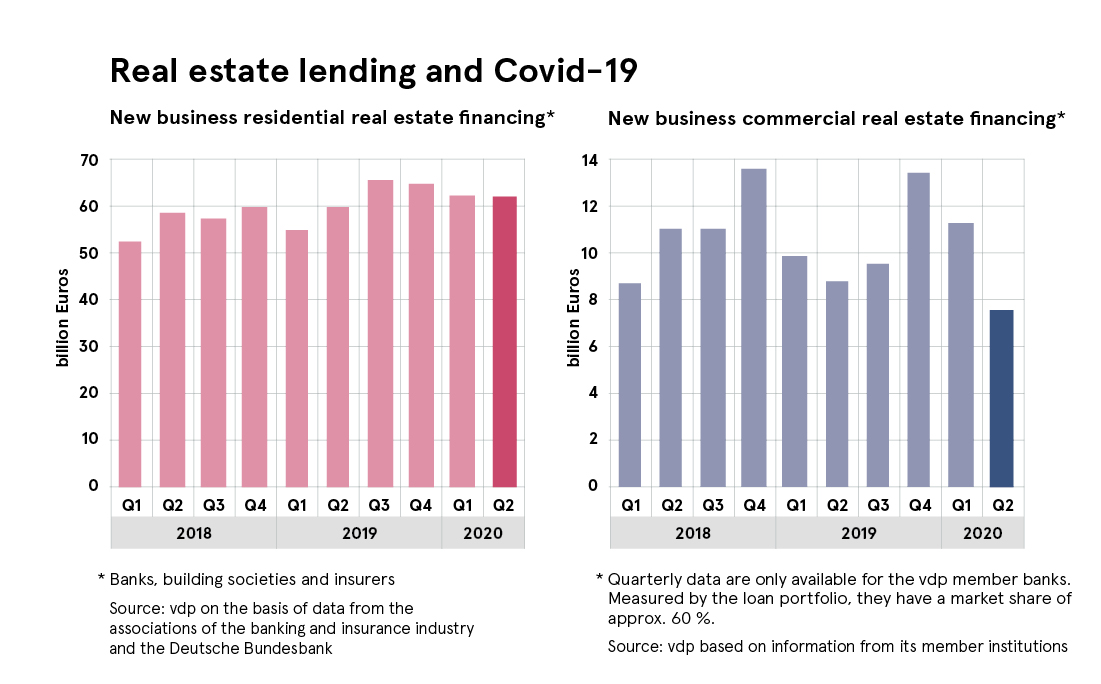

The Covid 19 pandemic had a dampening effect on real estate financing in Germany in the second quarter of 2020, with residential real estate financing being less affected than commercial real estate financing.

Residential real estate lending by the banking sector and insurers in Germany amounted to EUR 62 billion in Q2 2020, showing – untypically – a slight decline (-0.6 %) compared to Q1 2020. Normally, the second quarter is stronger than the first quarter of a year. A comparison with Q2 2019 also shows a slowdown in residential real estate lending in Q2 2020. While lending in recent years increased by an average of 6-8 % year-on-year, the increase in Q2 2020 was only 3.7 %. For the year 2020 as a whole, lending is expected to remain stable or increase slightly compared to the previous year.

The commercial real estate market reacts more quickly to economic influences than the residential real estate market. Accordingly, the impact of the pandemic on commercial real estate financing is stronger than on residential real estate financing. Q2 2020 has been the weakest quarter in the last two and a half years. Compared to Q1 2020, lending declined by around one third, and new business was 14 % lower than in Q2 2019. In the third quarter, several institutions have observed a recovery in lending, so that for the whole of 2020 a decline in lending is expected, but by no means a collapse in financing business.