The primary market of covered bonds has started 2024 on a strong note, with year-to-date issuance already more than half ABN AMRO’s total supply forecast for 2024.

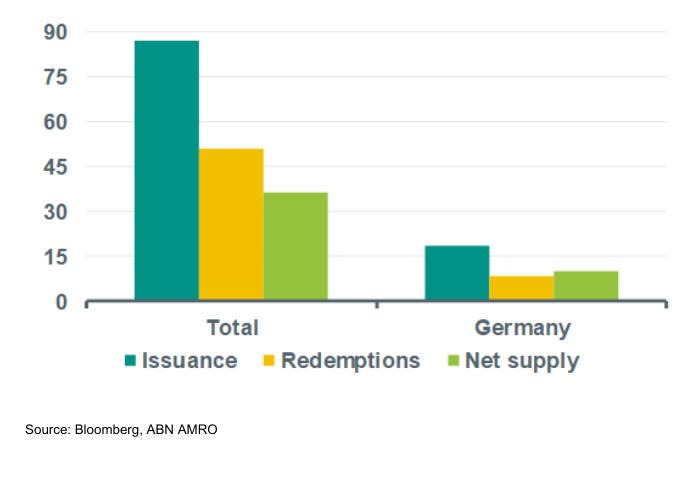

Issuance was likely supported by the EUR 250bn of TLTRO loans that banks repaid at the end of March, while favourable new issue conditions also were key drivers of the large amounts of new supply. So far, around EUR 87bn of euro benchmark covered bonds have been issued this year, which is below the more than EUR 100bn issued during the first four months last year, although it is close to the volume of new issuance in this period in 2022. Nevertheless, it is well above issuance volumes in 2017-2021.

German issuers have been among the most active in the euro benchmark covered bond market. The market has welcomed 18 German issuers so far this year and a total of 29 Pfandbrief transactions (in euro benchmark format). Seven German issuers have already tapped the market twice this year. Overall, the total volume of new issuance of German Pfandbriefe stood at EUR 18bn on 25 April, which accounts for 21% of total issuance.

New issuance of euro benchmark covered bonds 2024ytd (EUR bn)

In terms of net supply, the covered bond market kept on a path of sustained growth in 2024ytd. Comparing the volume of new issuance with the EUR 51bn of euro benchmark redemptions shows that the market for covered bonds has grown by roughly EUR 36bn. German Pfandbriefe played a key role here as well, given that EUR 10bn of the EUR 36bn of net positive supply was due to the heavy issuance of Pfandbriefe. This puts the German market in second place behind France.

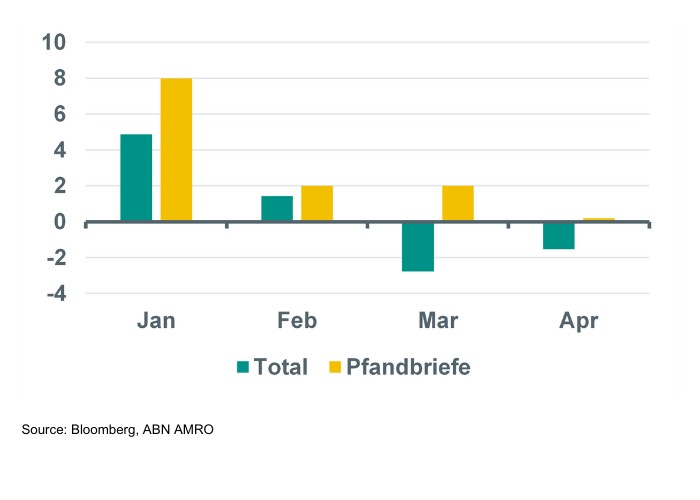

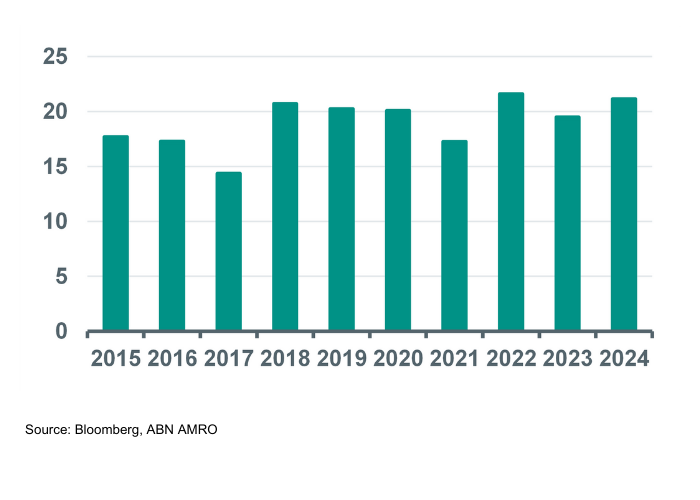

A breakdown by month showed that German issuers issued most Pfandbriefe already in January (EUR 11bn), accounting for 25% of total issuance that month. In February, issuance declined to almost EUR 3bn, while new supply of Pfandbriefe was only EUR 2bn in March. Issuance has picked up to EUR 3bn in April so far, albeit remaining well below January levels. However, the slowdown of issuance in February and March, when Pfandbriefe accounted on average for only 14% of total issuance, was likely payback for the large issuance volumes in January. Moreover, in April, the share of Pfandbrief issuance in the total has jumped back to 26%. Overall, the graph below shows that this year’s issuance of Pfandbriefe over total issuance of euro benchmark covered bonds has been in line with that seen in the past couple of years – having averaged 19% in the last ten years.

Share of German Pfandbriefe in total euro benchmark covered bonds in %

New issue premiums at historically low levels

The large volume of new supply (and also net supply) has been remarkably well absorbed by the market. This has been clearly reflected by a drop of new issue premiums into negative territory, implying that issuers were able to price new deals at tighter spread levels than where their outstanding covered bonds were trading before issuance. The reason for this was probably that covered bond spreads are relatively attractive versus other ranks of bank debt, and senior preferred debt in particular. Furthermore, covered bond spreads reached the widest levels seen since 2013-2014 earlier this year, which has most likely supported demand as well. Indeed, it seems that the covered bond investor base has grown (like the market itself), with asset managers in particular having re-entered the market. This has also been supporting spreads in the secondary market.

German issuers had to pay, on average, slightly higher new issue premiums than other issuers so far this year. This was likely related to the flaring up of worries related to commercial real estate and the relatively large CRE exposure of some German issuers that came to the market. However, during this year, German issuers have also benefitted from a decline in new issue premiums, with the average premium having dropped to zero in April. Looking forward, we expect spreads in the secondary market to better align with those in the primary market, which, as a side-effect, should result in new issue premiums becoming more ‘normal’ again in the coming months.

Average new issue premium paid in bps