With a new issue volume of EUR 40.6 billion, EUR benchmark covered bonds set a new record in a ten-year comparison. With EUR 10.5 billion, German Pfandbrief issuers made a decisive contribution to the strong start to the year. At the same time, the already strong previous year (January 2023: EUR 10.75 billion) was only just missed from a German perspective. Investors were offered a wide variety in terms of issuer selection, ESG criteria and maturity spectrum. The buyers’ market that was already evident last year continued in January 2024 and was reflected in a higher risk sensitivity for individual issues.

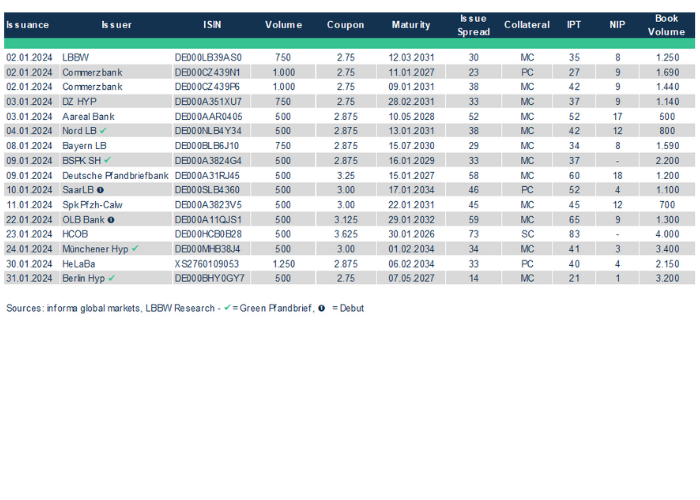

A total of 15 Pfandbrief issuers with 16 placements came to the market in the EUR benchmark segment in January. Landesbank Saar (Public Pfandbrief) and Oldenburgische Landesbank (Mortgage Pfandbrief) made their first appearances in the large-volume segment. Until then, both issuers had only been represented to investors with private placements and sub-benchmark issues. For the first time since May 2022, Hamburg Commercial Bank also made its first appearance from the north with a Ship Pfandbrief, thus contributing to further diversity in Pfandbriefe beyond mortgage and public sector cover.

The ESG segment was also well filled at the start of the year. NordLB, Bausparkasse Schwäbisch Hall, Münchener Hyp and Berlin Hyp provided further Green Pfandbrief volume. For the building society from Baden-Württemberg, it was the first green issue. The debut was announced at the end of last year following the establishment of the Green Bond Framework and has now been successfully completed. With an outstanding ESG volume of EUR 23.75 billion or a share of 28% of the total volume of ESG covered bonds issued, German Pfandbrief issuers continue to defend their leading position ahead of French institutions (EUR 23.0 billion or 27%).

A look at individual issuance parameters shows that a buyer’s market continued to prevail at the beginning of the year. This was all the more true in the first half of January. At an average of 9 basis points, the new issuance premium was above the overall market level (average 6 basis points). The wide range of 1 to 18 basis points indicates that investors also differentiated risk more strongly within the Pfandbrief segment. This was also underlined by the book-to-cover ratio with a range of 1x to 6.8x. Here, the average of 2.9x was slightly higher than the figure for the market as a whole (2.8x), which indicates a high level of willingness to take on new issues overall.

The year 2023 was characterized by repricing on the covered bond and Pfandbrief market, particularly after the ECB’s complete withdrawal from its CBPP3 purchases. As a result, Pfandbrief investors benefited from noticeably higher issue spreads of 40 basis points on average in January 2024 (January 2023: 7 basis points on average). Here too, a wide range of 14 to 73 basis points can be seen, depending on the issuer, maturity or type of cover pool assets, for example. The gradual decline in interest rate uncertainty also meant that longer maturities could increasingly be placed again. Accordingly, 38% of the Pfandbrief volume issued accounted for maturities in the 7-8-year maturity range. The 10-year maturity range accounted for 21%.

Overall, Pfandbrief issuers should be satisfied with the strong start to the year. The first Pfandbrief issues in February indicate that investor interest remains high. In our view, the risk differentiation between individual issuers – including with regard to corresponding headline risks (e.g. US office real estate) – is likely to continue over the rest of the year. It is also likely that the coming months will be characterized by increased maturity variations and a steadily growing importance of ESG placements.