Pfandbrief market 2023: Glass (more than) half full at the midpoint of the year

Dr. Frederik Kunze

NORD/LB

07.2023

Global markets for covered bonds in general – but also the Pfandbrief market in particular – were without a doubt significantly affected by the monetary policies pursued by the ECB in recent years.

Accordingly, the Eurosystem operated via the CBPP3, in particular, on the primary market for publicly placed deals as a purchaser of covered bonds with almost no regard for price sensitivity. On the other side of the coin, the central bank repressed supply on the public covered bond market through the attractively priced TLTRO III tender and by this means also forced issuers to exploit the option of using retained covered bonds as central bank collateral. Investors became the “victims” here in an undersupplied market. These circumstances were also obvious with regard to the Pfandbrief segment. Across the market, the compression of risk premiums and price differences also emerged as a further symptom of the ultra-expansionary monetary policy – even above and beyond the CBPP3 and TLTRO III. From the perspective of the Pfandbrief market, this led to a more and more marked levelling of the spread premiums of other covered bond jurisdictions compared with Pfandbriefe. Not surprisingly, the ECB’s gradual exit from its expansionary monetary policy approach also shaped and continues to shape the Pfandbrief segment in 2023. Key decisions in this regard had been taken significantly earlier. Among others, the central bank meeting on 27 October 2022 should be remembered in this context. Hence, the ECB’s Governing Council resolved to adjust the terms for existing TLTRO III tenders, which provided an immediate boost to covered funding – especially for German issuers. Accordingly, the Pfandbrief banks in Germany were among those issuers that refocused their funding mix comparatively early. Since mid-year maturing bonds purchased under the CBPP3 are no longer reinvested. The advance notification of this policy change has already had a sustained impact on the primary market and the focus is now switching to the months from July to December 2023.

Pfandbrief market on the growth path – particularly as far as EUR benchmarks are concerned

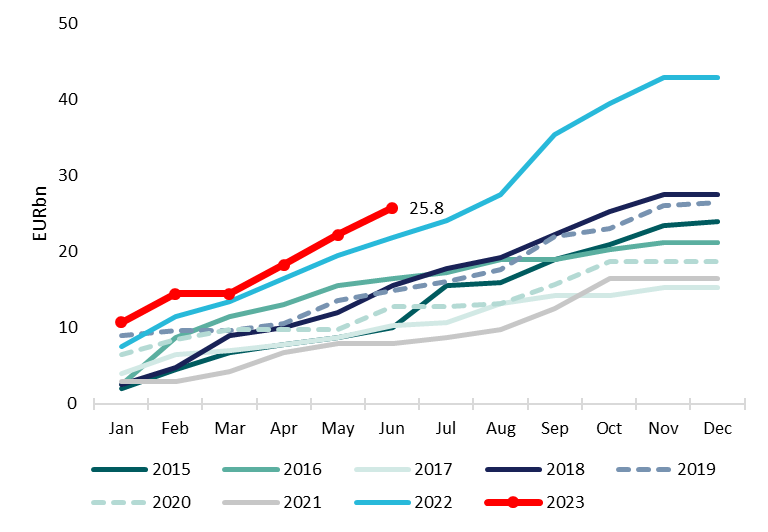

In the first half of 2023, Pfandbriefe (by this we consistently mean German Pfandbriefe) contributed EUR 26.3bn to the total issuance volume – compared with EUR 21.8bn in the same period in the previous year. As a result, Germany commanded – after France – the second largest share of primary market activity in the EUR benchmark segment for covered bonds in the first half of 2023. The Pfandbrief market remains on course for growth even when considered in net terms. Ultimately, at EUR 17.8bn, maturities in 2023 as a whole are already less than new issuance. The details reveal that a total of 17 issuers ventured onto the market in the months from January to June 2023 (same period in the previous year: 16) and placed 40 (28) deals. German issuers in the EUR benchmark segment have therefore been even more active than in 2022. In total, EUR 1.25bn was recorded in the EUR sub-benchmark in the first six months of this year. Activity in this segment is less dynamic than in the EUR benchmark segment, and issuance volume slightly less than for sub-benchmarks in the previous year. (EUR 1.6bn).

The high issuance volume is not least a consequence of the ECB’s monetary policy realignment. However, the continued high degree of uncertainty on international bond markets is also boosting the significance of covered funding for some banks. From an issuer’s perspective, higher risk premiums for senior unsecured bonds, for example, are generally making covered bonds more attractive. A basic shift in the funding mix must also be cited as an explanatory variable for the supply side involving Pfandbriefe. It was German banks, in particular that reacted comparatively early to the ECB’s announcement in October and switched their funding correspondingly rapidly from central bank liquidity. This development started in Q4 2022 and continued in the first weeks and months of the new year. The increases in deposits on the part of private households that were still dominant in the wake of the Covid-19 crisis are now also a thing of the past.

Who is buying the bonds supplied?

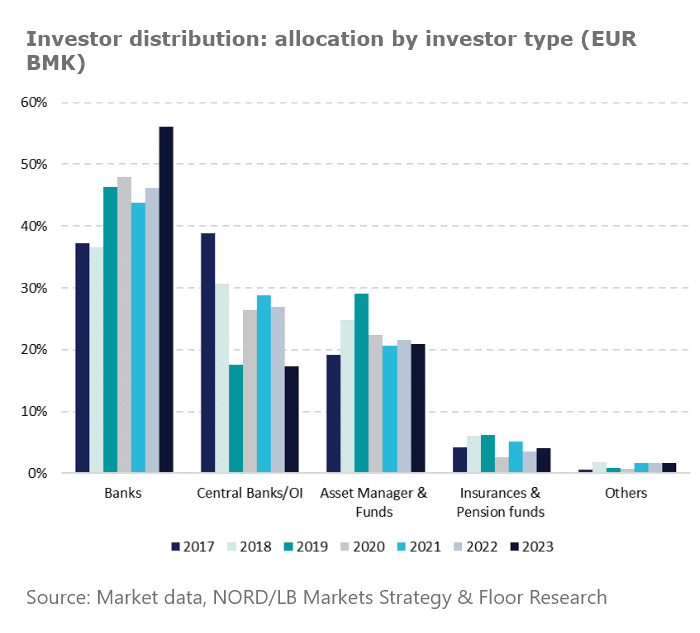

Significant issuance volumes in conjunction with the ECB’s withdrawal described above has without a doubt raised the question of the extent to which the supply of bonds can be absorbed on the market. And in actual fact it is clear that the gap left by the Eurosystem has been filled by other groups of investors in the first half of 2023. This is clearly apparent when looking at the shares of the “banks” investor group, which have risen significantly on average and where the share has risen to well over 50% for Pfandbriefe.

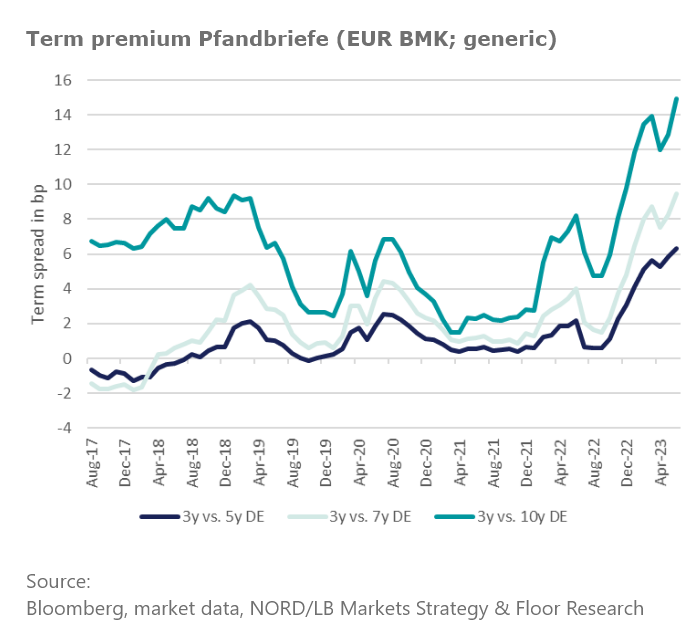

However, the fact that additional structural changes have taken place on the primary market should not be overlooked in this context. This is particularly true of the distribution of the initial residual terms to maturity. For instance, 34 of the 41 deals in total in the first half of the year feature initial residual terms of less than ten years, with 19 bonds even falling within the maturity segment of less than five years. This focus on the short end must be viewed initially as a response to actual demand from investors. Nevertheless, issuer calculations must also be included as a decisive factor. The negative slope of reference curves implies higher reoffer spreads for primary market transactions – if only to offset the negative term spread.

What will happen to spreads?

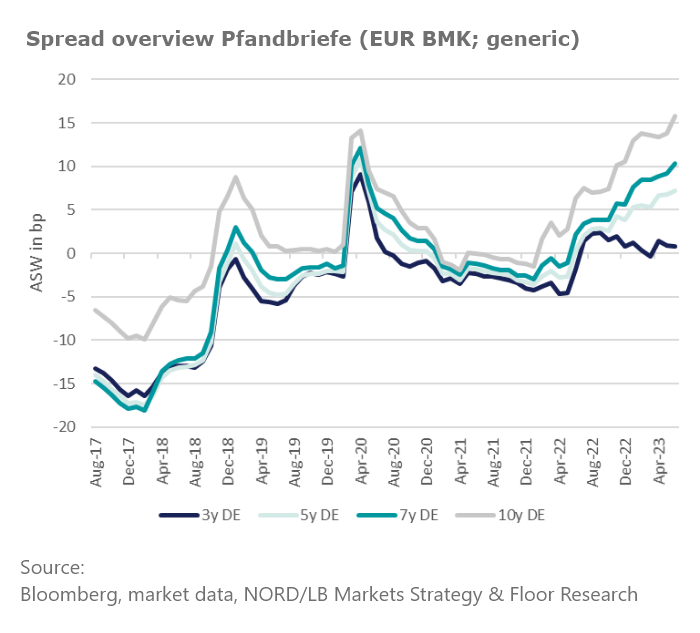

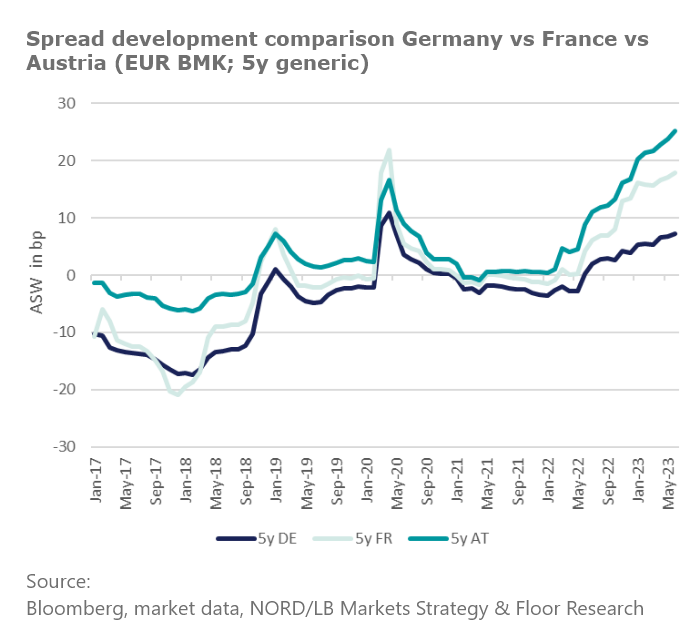

In the first half of 2023, a development also continued on the Pfandbrief market that had started in the first half of 2022 when the ECB first attempted to tighten monetary policy – and by no means did or does this only apply to the German covered bond market. Accordingly, the covered bond secondary market has undergone a significant repricing in the wake of primary market activity in recent months. In this environment, the generically derived Pfandbrief spreads rose sharply, reaching almost historic levels. However, the reversal of the compression affecting risk premiums also resulted in a disproportionate increase in covered bond spreads outside the Pfandbrief submarket. The spread premiums of covered bonds from France or Austria compared with Pfandbriefe are also a reflection of a significant “home bias”, which is essentially a given for the majority of covered bond jurisdictions. The substantial investor base in Germany supported and supports the spreads for Pfandbriefe here – even in relation to other jurisdictions.

The spread differences between the individual jurisdictions have already achieved a comparatively high level as a result of the repricing, meaning that a less steady picture should emerge for the spread trend over the second half of the year. This also means that more significance is to be attributed to price-determining factors at issuer or jurisdiction level over the next few trading months than was the case in the first half of the year.

What are the expectations for the Pfandbrief market in the second half of 2023?

As already mentioned, the repricing phase is likely to draw to a close in the first trading weeks of Q3 2023. Among other factors, this means that market-driven spread impulses are likely to be far more modest. The expectation of a substantial issuance volume in relation to the EUR benchmark segment (NORD/LB forecast gross supply: EUR 193.5bn) and with respect to Pfandbriefe in EUR benchmark format (forecast: EUR 33.0bn) in 2023 is also now likely to be largely priced in. However, the structure of the new bonds is less clear. This is particularly true in terms of the maturities that might be chosen. It is anything but far-fetched that even issuers in Germany are faced with the challenge of issuing longer maturities to satisfy their ALM requirements. However, historically high term spreads are still being inferred on the secondary market even for Pfandbriefe in EUR benchmark format. This is not by any means caused by deflection in the reassessment of the risks associated with longer dated deals. Rather, the term spread is a direct consequence of the state of the EUR swap curve.

While a “wait and see” attitude is likely to have been the dominant strategy in the first half of 2023 for some issuers, there are signs of a stronger focus on the “long end” for the remaining six months given that the inverted yield curve is expected to persist. The term spreads, which reflect the secondary market in the presentation of the generic spreads in the EUR benchmark segment below, are likely to be somewhat higher in the primary market. Consequently, the longer terms could widen even more. Sufficiently large investor interest should be generated via new issue premiums; however, secondary trading performance could well be slightly disappointing, which would be due in principle to the fact that this submarket is less liquid.

However, in an international comparison, this will not result in longer dated Pfandbriefe underperforming in relative terms. Ultimately, it is not likely by any means that German banks will be the only banks to focus more on longer maturities. By and large, the changes in global spreads should keep within limits from the perspective of the Pfandbrief. As with the majority of other jurisdictions, we do not see any fundamental reassessment of the risk situation. This applies both with regard to the credit quality of banks and in relation to cover pools. However, a differentiation of spreads according to issuer or Pfandbrief programme does not rule this out entirely. The “normal” price differences prior to the ultra-loose monetary policy emerged on the market and will do so again. The third key factor, albeit one that is more short-term in nature, driving prices cannot be ignored either. We would also classify the increasingly challenging situation on the market for commercial property financing in this context. In actual fact, a “quasi-fundamental” factor could therefore drive Pfandbrief prices somewhat in the second half of the year.

Conclusion

Ultra-expansionary monetary policy has shaped the Pfandbrief segment in the last decade. The large-scale withdrawal by the ECB was the driving force in the first half of 2023; it encouraged a substantial level of issuance and drove the repricing of Pfandbriefe. A dynamic primary market is also expected in the second half, meaning that Pfandbriefe in EUR benchmark format totalling EUR 33.0bn (NORD/LB forecast) will be placed by year-end 2023. With the existing maturities, this will result in net supply of EUR 15.3bn. However, this expectation per se will no longer drive spreads significantly. Yet, spreads are expected to widen among the longer maturities, which issuers are likely to increasingly focus on after the summer break. Even if issuers are likely to pay a comparatively high price for long maturities, the Pfandbrief will also demonstrate its importance in the second half of 2023 as well as its role as a stable and still comparatively inexpensive means of funding.