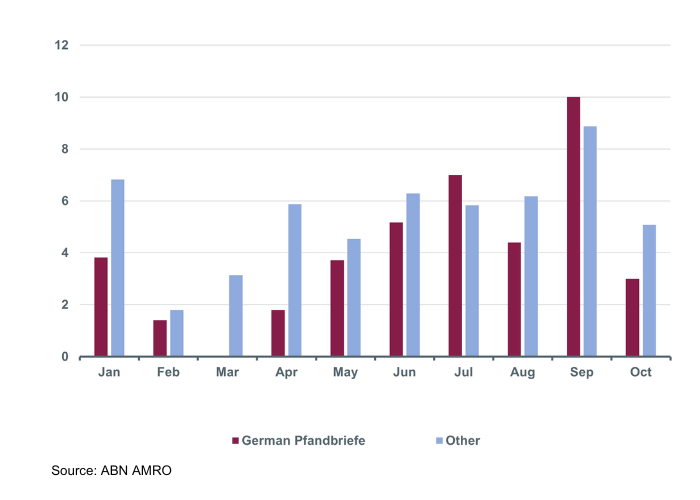

The primary market for euro benchmark covered bonds suddenly slowed down in September, while activity picked up slightly in October. This followed a strong start after the summer break and a record volume of new supply during the first half of the year. Total supply amounted to EUR 6.6bn in September and was EUR 10.25bn in October. This took issuance of euro benchmark covered bonds to EUR 176bn during the first ten months of 2023. This is just below the EUR 181bn that was issued during the same period in 2022, but almost double the supply volumes seen in 2020 and 2021. As such, the primary market probably needed a break.

Issuance of German Pfandbriefe slowed down disproportionately, as they accounted for 10% of total issuance during September and October on average, which compares to around 20% during the January-October period. This was likely related to the fact that German issuers had been relatively active earlier this year. Besides refinancing EUR 18bn of redemptions up until October, they issued an additional EUR 15bn, implying strong net positive supply. This was likely supported by TLTRO-III repayments (and particularly those in June) together with still growing mortgage lending.

However, the impact of the unprecedented increase in central bank policy rates is increasingly taking its toll on the economy and bank lending. Indeed, as economic conditions weaken – the eurozone economy as well as the German economy shrank slightly in Q3 – banks continue tightening lending conditions significantly, and demand for loans has stalled. As a result, bank funding needs will likely remain modest.

Furthermore, market conditions were not optimal during September and October, as sentiment in financial markets was dominated by fears that interest rates would remain ‘higher for longer’. This not only led to a rise in interest rates not seen since the Global Financial Crisis but went hand-in-hand with a bear steepening of the curve. Overall, this resulted in investors shifting into a risk-off mode. Consequently, covered bond issuers had to pay somewhat higher new issue premiums to attract sufficient demand for new deals. Indeed, the average new issue premium was around 7bp in the past two months, compared to 4bp during the first half of the year and 6bp in July and August.

Average new issue premium paid, in bp

Zooming in on the three German issuers that came to the market in September and October, it was interesting to see that the long 4y deal of the German Pfandbriefbank issued in September only got a lukewarm welcome from investors. The deal was printed at MS +27bp, which offered a 10bp new issue premium. However, the fact that the final order book was not published suggest that the deal failed to gain traction. The soft reception was probably related to the fact that the bank has relatively large exposures to commercial real estate, with the ‘higher for longer’ fears also focussing on this segment of the market. Another factor at play is that the Eurosystem has stopped purchasing covered bonds within its purchase programmes since July, which probably has made other investors also more selective in the bonds that they buy. However, the two German banks that came to the market in October, LBBW and HESLAN, had a smoother ride, with their deals attracting solid demand, while the issuers paid only a small new issue premium (of around 3bp). This illustrates that the window to the market remained open, despite investors being more selective.

Looking forward, we expect issuance to remain modest during the remainder of the year, as most banks have likely completed their covered bond funding programmes, while funding needs remain limited. But if conditions are good, banks might prefer to pre-fund already parts of their 2024 funding plans. At the start of November, the market seems indeed more receptive for new deals.