The EU Taxonomy and Green Pfandbriefe

Matthias Fischer

Association of German Pfandbrief Banks

Sascha Asfandiar (LL.M.)

Association of German Pfandbrief Banks

07.2022

On July 12, 2020, Regulation (EU) 2020/852 of the European Parliament and of the Council establishing a framework to facilitate sustainable investment and amending Regulation (EU) 2019/2088 entered into force. It is better known as the “EU Taxonomy Regulation”. This regulation is a key part of the EU action plan on financing sustainable growth published in 2018, which aims to channel capital into sustainable investments and thus contribute to the EU Green Deal’s main goal of zero net greenhouse gas emissions in the EU by 2050.

In short, the taxonomy, which is ostensibly intended primarily to improve transparency, is one of the most important regulatory cornerstones for combating climate change in the European Union and is intended to support the transformation of the European economy in line with EU-wide climate targets or the goals of the Paris Climate Agreement.

Building sector important for achieving climate goals

The building sector plays an important role in the necessary transformation; after all, according to the EU Commission, it accounts for around 40% of energy consumption and 36% of greenhouse gas emissions in the EU. To achieve climate neutrality by 2050 – or even by 2045 according to the German Climate Protection Act – massive efforts will therefore be needed to improve the energy quality of buildings. This applies both to new construction and, in particular, to the reduction of consumption and emissions in existing buildings through energy-efficient refurbishment.

The taxonomy classification system

The EU Taxonomy Regulation classifies economic activities and defines when they are environmentally sustainable. This is the case when the activity makes a significant contribution to one of the six environmental objectives defined in the taxonomy and at the same time does not significantly harm any of the other environmental objectives (Do no significant harm, DNSH). For this purpose, certain Technical Screening and DNSH criteria must be met, depending on the economic activity. These criteria are set out in so-called delegated acts, which supplement the taxonomy in regulatory terms. Currently, these legal acts already exist for two of the six environmental goals, namely the environmental goals “climate change mitigation” and “climate change”.1

Legal acts with Technical Screening criteria for the other four environmental goals were originally to be finalized by the end of 2022. Initial proposals from the Platform on Sustainable Finance (PoSF)2 with recommendations to the EU Commission for the development of corresponding Technical Screening criteria were indeed submitted on March 31, 2022. However, the subsequent consultation and legislative process will probably drag on into the coming year.

Relevance of the taxonomy for Pfandbrief banks

For real estate financing and Pfandbrief banks, the focus to date has been on the environmental objective of climate change mitigation: with regard to the buildings sector, in addition to various individual measures, the Delegated Act identifies in particular the economic activities of new construction (7.1.), renovation of existing buildings (7.2.) and acquisition and ownership of buildings (7.7.) and provides them with corresponding Technical Screening and DNSH criteria. Only if Technical Screeing and DNSH criteria are all met and the minimum safeguards are observed can an economic activity – e.g. the construction of a new property – be classified as taxonomy-compliant.

For Pfandbrief banks and their real estate financing and funding operations, the focus is on the financing of existing buildings (acquisition of and ownership in buildings) and of new buildings; the granting of renovation loans is also important and will gain further relevance in the future.

Environmental goal climate change mitigation: Technical Screening and DNSH criteria for economic activities in the building sector

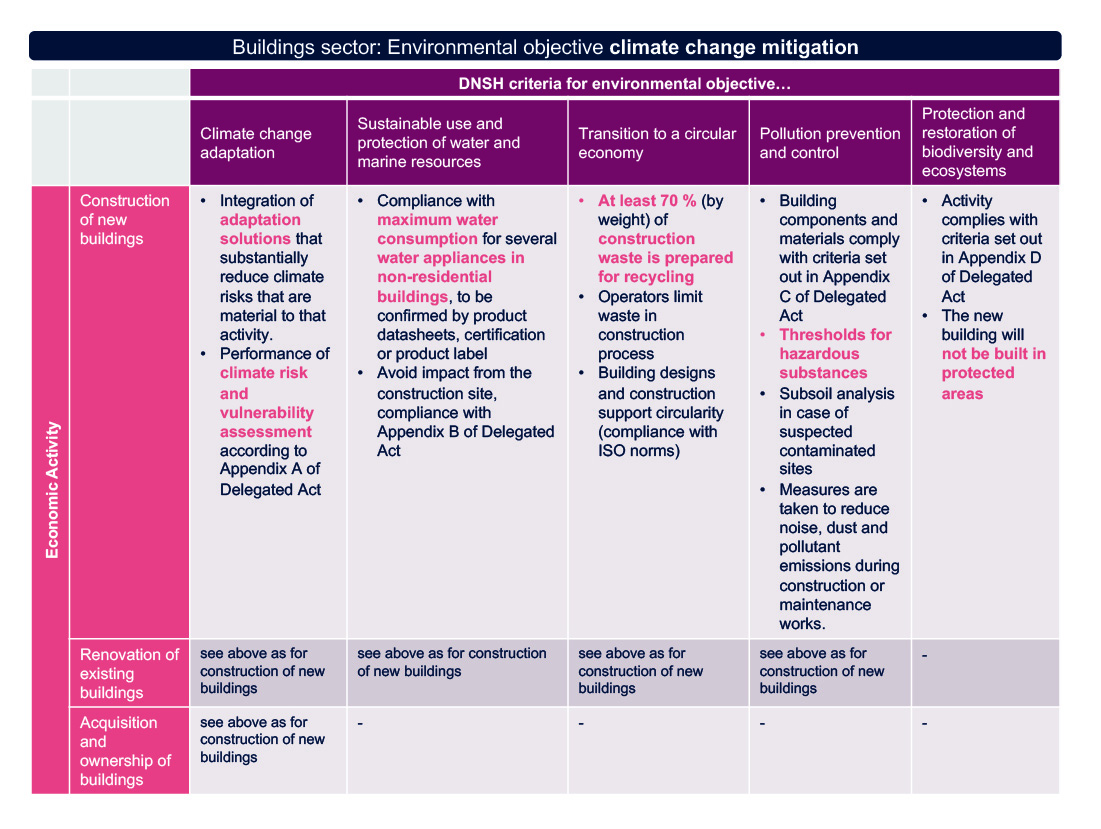

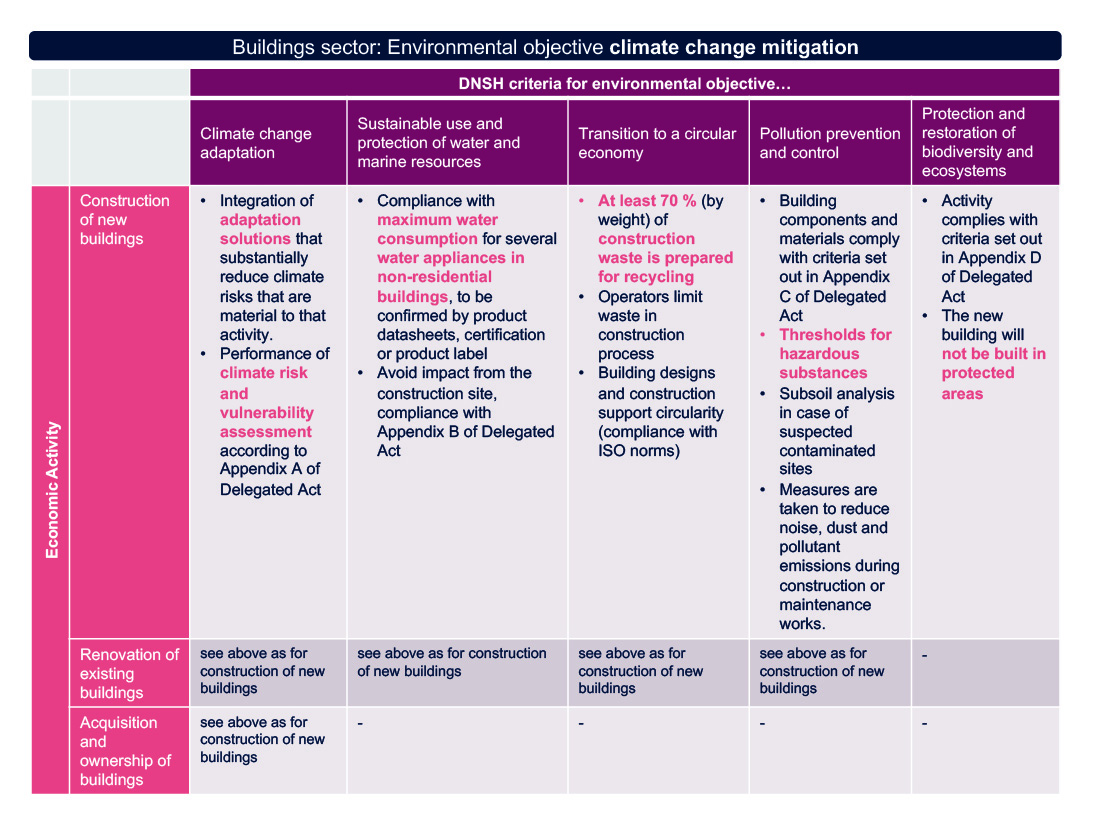

Considering the Technical Screening (see Fig. 1) and in particular the DNSH criteria (see Fig. 2) for the environmental goal of climate change mitigation in the building sector, it quickly becomes clear what extensive data is necessary or will be necessary in order to determine the taxonomy alignment of an economic activity and thus to finance real estate or renovation activities within a framework of taxonomy-compliant “Green Loans” or to use taxonomy-compliant EU Green Bonds for refinancing.

Fig.1: Technical Screeing criteria for the building sector according to the Delegated Act on the Environmental Objective Climate Change Mitigation. Source: vdp

The required information goes far beyond the data currently usually available in the context of real estate financing: While basic information on the energy quality of buildings can be obtained, e.g., by recording and collecting energy performance certificates, it gets more difficult when it comes to the DNSH criteria (see Fig. 2):

Fig.2: DNSH criteria for the building sector according to the Delegated Act on the environmental target climate change mitigation. Source: vdp

Data availability and feasibility of DNSH criteria poor

For example, in the context of a new building project, individual, known physical risks (e.g. flood risks) are examined on the basis of past data during the planning and building approval process. However, a future-oriented – the projection period according to the taxonomy is 10-30 years – individual analysis of individual physical climate risks does not take place. The requirement to integrate and implement adaptation measures for appropriately identified physical climate risks also goes well beyond current building code requirements.

Another example of the difficulty in implementing the taxonomy criteria are the specifications for water fixtures in non-residential buildings in new construction and renovations: The installation of water fittings is not regulated by law with regard to maximum consumption and flow rates stipulated in the taxonomy, so that corresponding information is often neither available nor is there corresponding documentation in the planning process.

Binary system – lack of incentives for transitory activities

With its binary approach, the taxonomy requires compliance with all assessment and DNSH criteria. There is no weighting, all criteria are rank equally: For example, if only one supposedly secondary DNSH criterion, such as water fixture requirements, is not met, the activity as such is not taxonomy compliant. Another point of criticism of the taxonomy is the lack of support for transitory activities: instead of starting where the greatest, e.g. energy savings potential exists, the current logic of the taxonomy with its best-in-class approach and its dichotomy between green and non-green means that the gradual transformation of the building sector and its financing is hardly incentivized. The idea of a so-called Extended Environmental Taxonomy, which instead of a binary system provides for a three-tiered approach to assessing the sustainability of economic activities, is therefore a step in the right direction. Similar considerations of the PoSF, however, contain approaches that would lead to questionable results.3 For example, a building could also be classified as “brown” or “red” in this three-tier system if only one of the relevant DNSH criteria were not met.

Applicability for Pfandbrief banks hardly given at present

The basic idea of using a classification system to steer investments into sustainable projects and thus support the fight against climate change is welcome. Unfortunately, the taxonomy in its current form is hardly applicable in practice for real estate financing and the refinancing of Pfandbrief banks. Obstacles include its excessive complexity and the large number of criteria: With regard to the data required for verification, there is a lack of both structured, uniform collection and national or European databases to which financial institutions and other market participants have access.

Also, with regard to the application or interpretation of the taxonomy and its assessment criteria, too many central questions currently remain unanswered, leading to great uncertainty and reservations about its use. In addition, it can be stated that the activity-based logic of the taxonomy does not match the time-period-based and long-term-oriented real estate financing business in many respects. In this context, fundamental issues arise, such as grandfathering: in order to provide investors with certainty and predictability, assets such as “green buildings” should retain their “taxonomy-compliant” status throughout the lifetime of the loan financing the asset. Investors may otherwise be reluctant to invest in an activity that currently meets taxonomy requirements, but whose taxonomy compliance may be revoked during the investment period due to a revision of the taxonomy and/or its technical screening criteria.

Green Pfandbriefe and taxonomy

Pfandbrief banks under the umbrella of the vdp and active in the green segment have drawn up minimum standards for the issuance of green Mortgage Pfandbriefe in 2019. These are traditional Mortgage Pfandbriefe under the Pfandbrief Act backed by green real estate financings.4 The standards are based on the ICMA Green Bond Principles, the internationally recognized set of rules for green bonds, and in particular define specific criteria for suitable assets in addition to transparency and quality standards. In order to bring the standards into line with the different business models of the Pfandbrief banks, the criteria have been kept diversified. Therefore, the following alternatives

- maximum values for the energy consumption/demand of a building depending on the building type,

- the use of the top categories of certain sustainability certificates,

- co-financing via KfW support programs for energy-efficient construction or refurbishment, and

- the residential building the belongs to the top 15 % of the national residential building stock in terms of energy consumption / demand

are provided for.

At the time the standards were established, work on the EU taxonomy regulation had not yet been completed, but its direction was already foreseeable. The Top 15 % approach was taken up and orientation towards the Technical Screening criteria of the EU Taxonomy and the expected EU Green Bond Standards as well as a regular review of the minimum standards were stipulated.

Accordingly, the contents of a first revision are currently being discussed. The focus is on a percentage EU taxonomy compliance floor for suitable assets as well as a disclosure of the share of suitable assets that are EU taxonomy compliant. Although the ambitions are high, everything depends on the feasibility and practicability, which in turn are linked to different factors. In this respect, there is no alternative to a transitory approach. It is due to the characteristics of the asset side that green alignment of the Pfandbrief banks’ portfolios can only be implemented in the long term. A taxonomy conformity of the assets of 100%, as envisaged by the proposal of the EU Commission for a voluntary EU Green Bond Standard,5 currently appears to be wishful thinking.

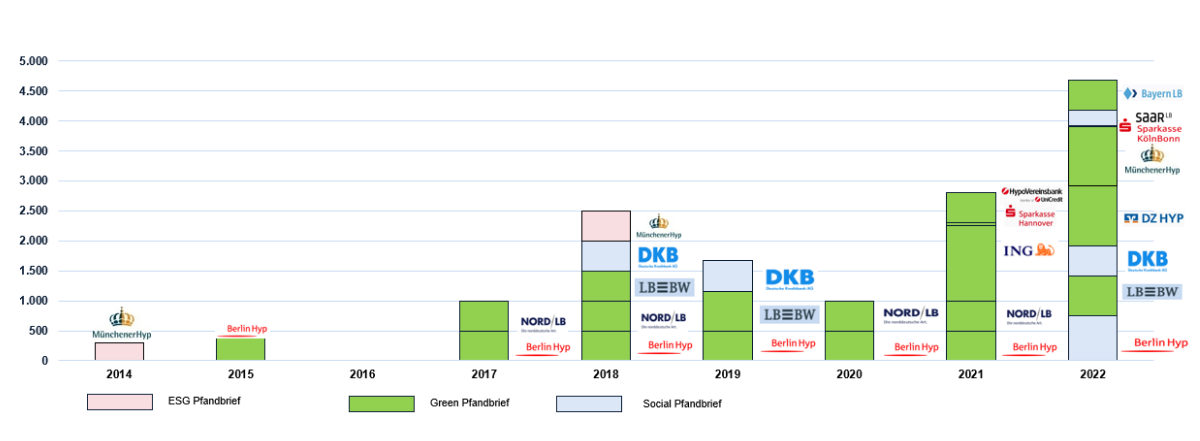

Sustainable finance market – the investor perspective

Pfandbrief banks are already among the most active credit institutions in Europe in the field of sustainable bond issues. They issue both unsecured green bonds and Pfandbriefe in all ESG varieties. In the latter, they rank first in the sustainable covered bond segment worldwide, with 22 Pfandbriefe outstanding from 10 issuers and a total outstanding volume of just under EUR 12 billion as of mid-June 2022. The rising volume is in line with the increased demand from investors. The extent to which taxonomy compliance will play a role for them in the future remains to be seen. Many already consider the ESG sector to be over-regulated and the multitude of laws, regulations and requirements to be difficult to understand and hardly applicable. Key figures such as the Green Asset Ratio (GAR) or EU taxonomy compliance are currently not yet relevant for investment decisions. Instead, industry standards and practices are relied upon.

Fig.3: Sales of sustainable Pfandbriefe 2014 – 2022ytd (€mn as at end June); source: vdp

Conclusion

Pfandbrief banks are committed to the goal of the 2015 Paris Climate Conference to limit global warming to a maximum of 2 degrees. They can only contribute indirectly to achieving the climate targets because they do not construct or renovate buildings themselves. What they can do, however, is create incentives for energy-efficient buildings when financing corresponding projects, for example by offering attractive loan conditions for “green renovation.” This applies to both commercial and residential properties. Accordingly, several Pfandbrief banks already have green real estate financing programs on offer and are very active on the issuing side in the ESG segment.

There is no doubt that the EU taxonomy would be suitable as a foundation for European ESG regulation to meet climate targets in particular. However, until broad applicability is ensured, success is uncertain. The over-engineering that can be observed is unhelpful and represents a significant hurdle for relevant stakeholders.

- footnotes:

- Delegated Act (EU) 2021/2139 of June 4, 2021, https://eur-lex.europa.eu/legal-content/DE/TXT/?uri=CELEX%3A32021R2139

- The PoSF a permanent expert body of the European Commission established to support the development of sustainable fiscal policies, including EU taxonomy.

- https://ec.europa.eu/info/sites/default/files/business_economy_euro/banking_and_finance/documents/220329-sustainable-finance-platform-finance-report-environmental-transition-taxonomy_en.pdf

- See more at https://www.gruener-pfandbrief.de Work is already taking place on minimum standards for Green Public Pfandbriefe.

- https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:52021PC0391