The EU Commission is currently working at full speed on the legislative draft for the European implementation of the finalised Basel III regulatory framework – called Basel IV because of its extensive impact in the industry. Several impact studies show that Basel IV can lead to significantly increasing capital requirements. Against the background of the current challenges, in particular the reconstruction after the pandemic and the fight against global warming, the financing of investment must continue to be ensured. Pfandbrief banks stand ready as financing partners provided the new regulatory requirements do not go beyond the internationally agreed level and European specifics are adequately taken into account.

The European Banking Authority (EBA) published impact studies on the implementation of Basel IV in the EU in 2019 and 2020. According to its recommended implementation options, capital requirements would increase significantly. For all EU institutions included in the impact study, the increase is around 20% on average and slightly higher for European mortgage banks. For the German institutions considered, EBA even calculates an increase almost twice as high, at just under 40%. This is mainly due to the fact that Basel IV, by introducing a capital floor, the so-called output floor, disproportionately increases the capital requirements for low-risk business such as real estate financing.

Until now, banks using internal models have determined individual and risk-sensitive capital requirements for each borrower. These internal models have been approved by the responsible supervisory authority, are continuously reviewed by it and benchmarked in Europe-wide comparative calculations. In addition, the regulatory and supervisory requirements for the use of internal models have been fundamentally expanded and standardised in recent years. This serves to improve the comparability of the internal models used and further increases their reliability.

This European path is not pursued at the global level with Basel IV. Instead, the supervisory goals are to be achieved through the instrument of the output floor. However, the output floor is based on the standardised approaches for determining capital requirements. This means that individual risks of individual borrowers are not addressed, so that especially in the case of low-risk transactions, no risk-sensitive capital requirements are applied, but rather the general requirements from the standardised approaches. In contrast, higher-risk transactions show higher capital requirements using internal models, so that the output floor does not lead to higher capital requirements for these transactions.

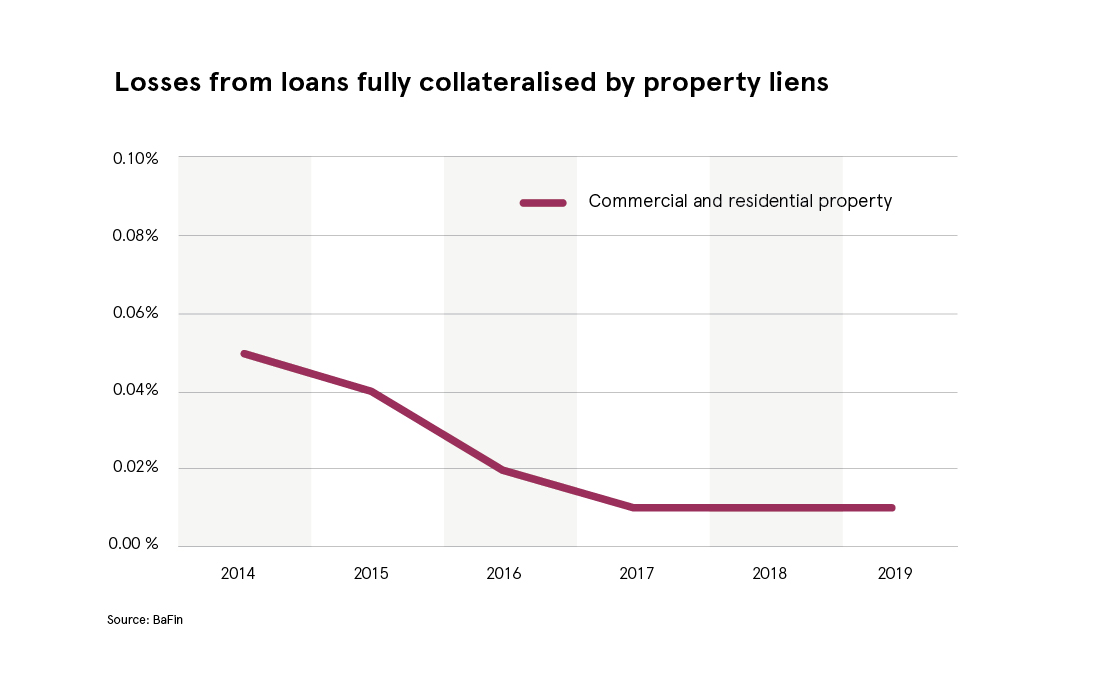

Since the real estate financing business in Germany tends to be low-risk, a non-risk-sensitive output floor has an even stronger effect and leads to the aforementioned high increases in capital requirements. The fact that the real estate financing business in Germany is low-risk has also been shown for several decades by realised losses of loans fully secured by real estate. This ratio is significantly below the regulatory limit of 0.3% in residential and commercial real estate financing. BaFin has published this ratio since 2014, which has developed as follows:

From an economic point of view, the inevitable consequence of a capital requirement that is no longer risk-sensitive is the tendency towards higher risks, since higher margins can be achieved with such transactions without further increasing the capital requirements. However, this cannot be in the interest of prudential regulation. In addition, the comparability of the institutions’ capital requirements deteriorates. For the same capital requirements, there can be significantly different actual risks.

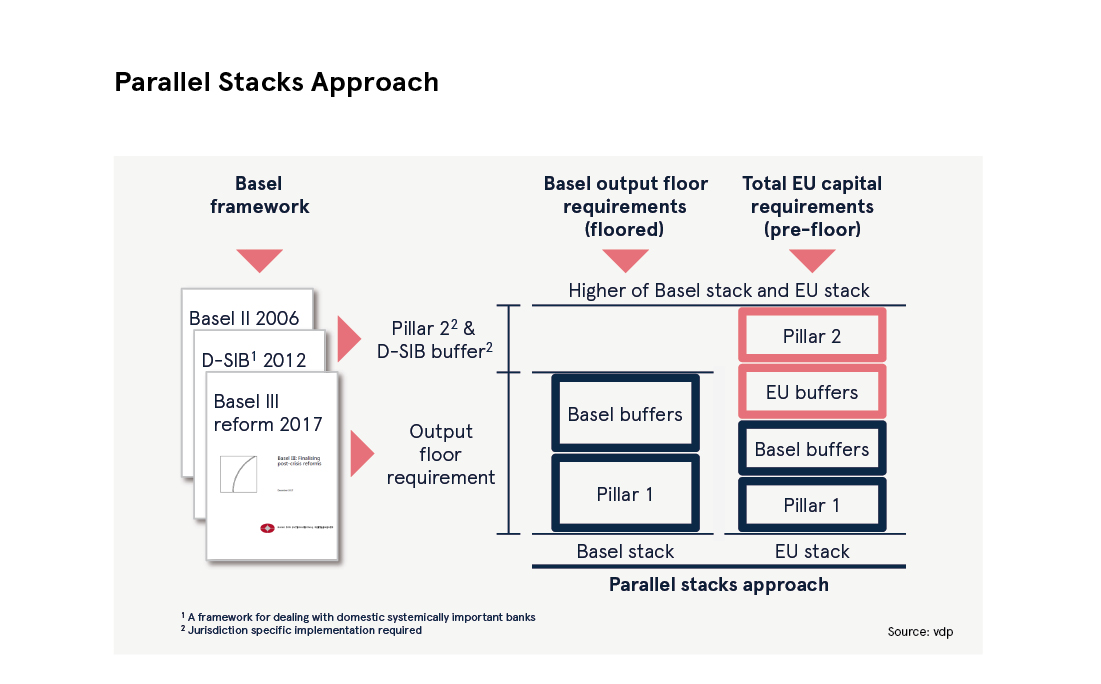

The goal of the EU implementation of Basel IV must therefore be to maintain risk-sensitive capital adequacy. With regard to the output floor, the so-called parallel stacks approach can be used as a parallel calculation.

In this implementation option, the Basel output floor is implemented literally and in its pure form in the EU, i.e. the regulatory minimum capital requirements in Pillar 1 and the capital buffers specified in detail by Basel. But instead of the EBA recommendation to simply add the additional capital requirements on top in the EU to the output floor requirement, all relevant capital requirements in the EU are determined in parallel without taking the output floor into account. The higher of the two requirements (Basel stack vs. EU stack) then determines the total capital requirement. Since the EU capital requirement is regularly higher than the output floor requirement, it is ensured that the Pillar 2 requirements (additional supervisory requirements) and the requirements for otherwise systemically important banks (D-SIB), which are provided for in Basel but have to be implemented jurisdiction-specifically, are also addressed.

A survey conducted by the vdp among a sample of its member institutions shows that risk-sensitive capital requirements are still possible with this approach. It also makes banks‘ capital requirements better comparable, as the amount of regulatory capital can only be assessed by taking into account the risk at hand. In addition, the unintended significantly higher capital requirements can be diminished considerably.

For real estate financing in Germany, this would continue to allow risk-adequately low consumer interest rates, as no increased regulatory costs, such as those that would otherwise arise from additional required equity, would have to be passed on. Together with the favourable funding via Pfandbriefe, this would further lend support to the traditional long-term financing of real estate that has proven itself in Germany over many decades.