The performance impact of equivalence

The implementation of the Basel III reforms has been the long-awaited opening to the introduction of preferential risk weights for covered bonds outside Europe. While several third countries now provide for a favourable risk weight treatment, this has failed to unlock much additional investor demand so far. Yet, from a level playing field perspective, such a preferential recognition is often dubbed important for the EU’s equivalence decision on the risk weight treatment of third country covered bonds. An outcome that would not only benefit third country banks from a funding cost perspective, but also European investors from a performance and diversification angle.

Singapore, South Korea, Australia and Switzerland are all examples of jurisdictions that implemented the BCBS requirements for the preferential risk weight treatment of covered bonds. Instead, in Canada credit quality step (CQS) 1 rated covered bonds meeting the asset eligibility and disclosure requirements for covered bonds of the Basel reforms, plus a minimum 5% overcollateralization requirement, still only benefit from a 20% risk weight under the standardised approach. If these requirements are not met, the covered bonds would be risk weighted based on the external credit rating of the issuing credit institution. Thereby the risk weight treatment of covered bonds in Canada is arguably stricter than in New Zealand, that doesn’t provide for separate risk weights for covered bonds. In New Zealand the risk weight classification of covered bonds is still based on the rating of the (covered bond) claim without any further conditions.

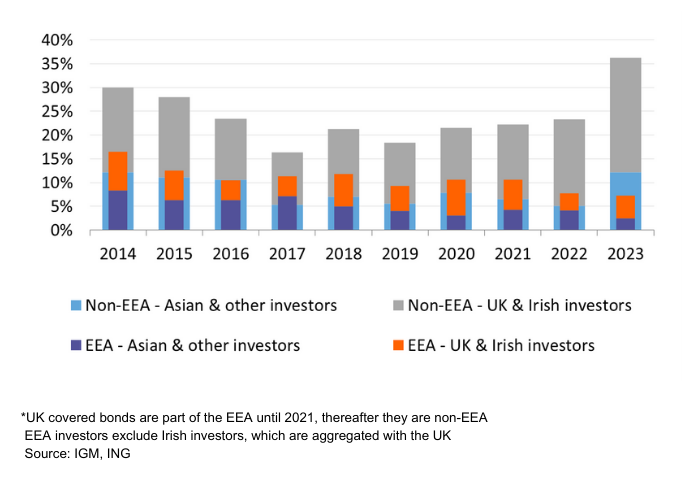

While countries such as Singapore and Switzerland do not apply the requirements from the Basel-III reforms yet, the application thereof in the other jurisdictions has so far not resulted in a visible additional investor demand from third country markets for EUR covered bonds. In fact, during the last two years third country investments in new EEA EUR covered bonds have even declined a tad despite the reduced and ending allocations to the CBPP3 for Eurozone covered bonds. EEA investors are in turn the largest buyers of third country EUR covered bonds in the primary market (at 76%). A third country equivalence regime for non-EEA legislative covered bonds will for that reason probably be welcomed warmly by EEA investors.

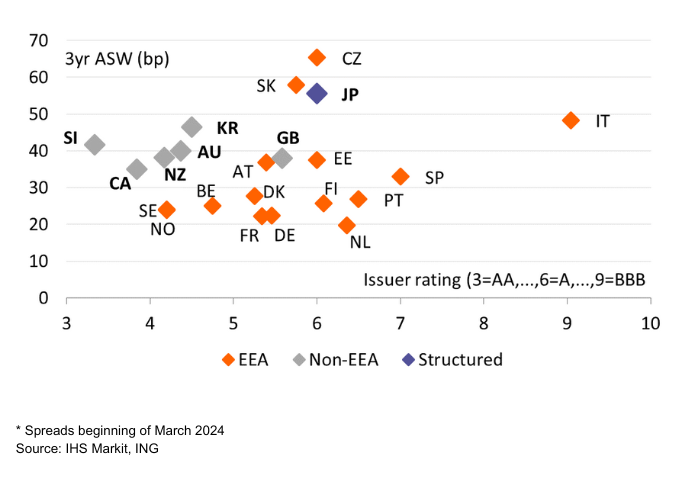

For third country issuers, an equivalence regime will likely have the supportive side effect of broadening the interested EUR investor base for their covered bonds. Third country covered bonds historically trade persistently wider than covered bonds issued by banks located in the European Economic Area (EEA), reflecting the less favourable risk weight and LCR treatment for these bonds within the EU. Unless the issuing bank is based in a G10 country (such as Canada or the UK), third country covered bonds are also not accepted for ECB collateral purposes.

Participation non-EEA & UK investors in EUR covered bonds of EEA and non-EEA based credit institutions*

When it comes to a favourable outcome on the third country equivalence decision by the European Commission, we believe that third country covered bonds should overall have some 5bp narrowing potential at current levels. But first the EBA will deliver its advice on this topic to the European Commission before the end of June 2025. Even upon such a positive decision by the European Commission, it remains yet to be seen whether the spreads of G10 third country and Nordic covered bonds would then converge in full. The total European investor base for these covered bonds may still stay smaller than for covered bonds from European markets.

Third country covered bonds trade 15bp wide to Nordics*

This contribution is an executive summary of a longer research piece conducted by the author and her team at ING.