10 largest Pfandbrief issuers according to Pfandbrief outstanding

Christian Walburg

Association of German Pfandbrief Banks

06.2021

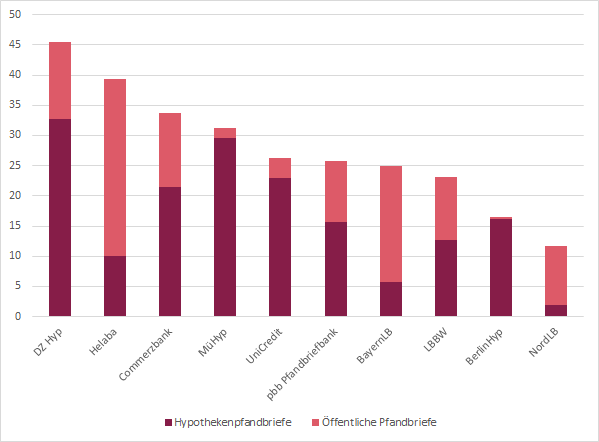

Of a total of 79 Pfandbrief issuers publishing transparency data in accordance with Art. 28 Pfandbrief Act, the ten largest have an outstanding volume of Eur 278bn (72 %) at the end of the first quarter of 2021. A year earlier, the figure was Eur 273bn (74 %).

The remaining 69 issuers have thus caught up in the pandemic year. The distribution between mortgage and public sector lending ranges from predominantly mortgage-driven and mixed forms to predominantly public sector lending. Mortgage Pfandbriefe dominate the circulation of the largest ten issuers by about two-thirds, with Eur 169bn compared to Eur 109bn Public Pfandbriefe.

Among the ten institutions with the largest Pfandbrief volume outstanding are four specialised institutions, four public-sector issuers and two universal banks.

With the upcoming merger of Deutsche Hypo into NordLB in the summer of this year, the merged institution will catch up with LBBW with around € 23bn Pfandbrief outstanding and Aareal Bank will move up into the group of the ten largest issuers with some € 12bn outstanding.

Pfandbrief outstanding (Eur bn)