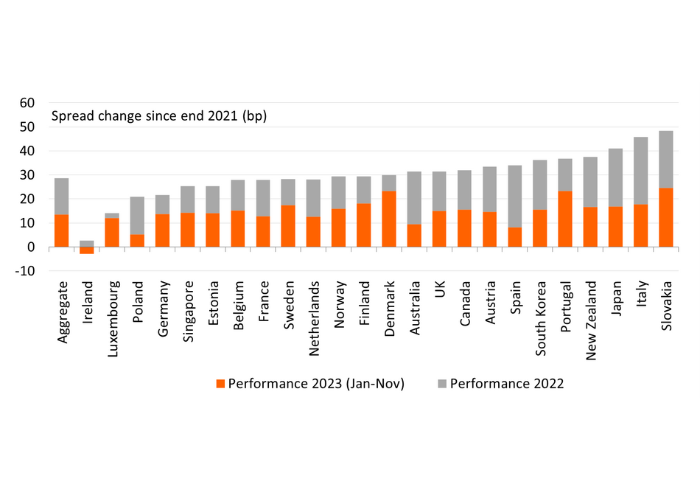

German Pfandbriefe have been among the more resilient performers in the past two years. The iBoxx Germany covered bond index widened by 14bp in 2023 YTD and by 8bp in 2022 against the backdrop of the rising yield levels and the phasing out of central bank support.

Well-known factors such as the strong home country investor demand, Germany’s solid legal framework for Pfandbriefe and the perceived systemic importance of Pfandbriefe in Germany form part of the explanation. So do the Bund trading levels, which were particularly constructive to Pfandbriefe in 2022.

Pfandbrief spreads came under a little bit more pressure in 2023 compared to last year. The normalisation of the Bund asset swap spread levels played a role here, but so did supply. Against the backdrop of the TLTRO-III repayments, EUR benchmark issuance by German issuers stayed irrevocably high in 2023 at €38bn YTD (versus €43bn in 2022). Supply exceeded redemption payments by €18bn. Property market concerns also started to weigh more on performance. Both commercial and residential property prices are declining in Germany since mid-2022 according to the vdp quarterly Property Price Index. On top of that economic growth conditions became more sluggish, with YoY German GDP growth tipping into negative territory in 2023.

We do note however that the covered bond performance differences became smaller in general this year compared to last year. German Pfandbriefe still find themselves in the better performing segment, with a YTD spread widening that is flat in line with covered bond aggregate.

German Pfandbrief among less spread pressured covered bonds