Low interest rates and attractive short-term funding provided by the European Central Bank (ECB)’s Targeted Long-Term Refinancing Operations III (TLTRO III) are pushing the issuance of benchmark Pfandbriefe towards longer maturities. However, the resulting weighted average residual life of outstanding Pfandbriefe is relatively stable, at about 5.5 years.

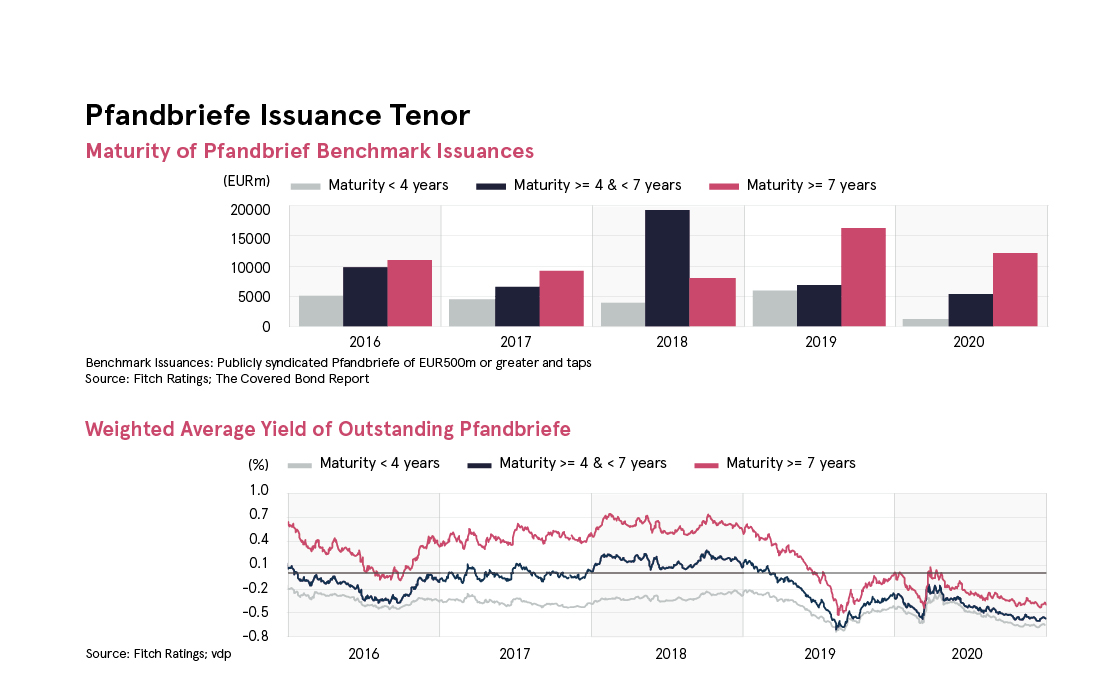

The weighted average residual life of outstanding German covered bonds (Pfandbriefe) has long been stable at about 5.5 years. This results from two diverging trends. The average maturity had increased by end-2020 to 8.7 from 6.7 years in 2018 for newly issued benchmark Pfandbriefe with a minimum size of EUR500 million and placed in the public market, and was balanced by the shorter-term retained Pfandbriefe used in central bank operations.

The Targeted Longer-Term Refinancing Operations (TLTRO) III launched by the ECB in March 2019 acts as an attractive source of three-year funding for issuers. As a consequence, new publicly placed, benchmark-size Pfandbriefe, with maturity of less than four years, became insignificant in 2020.

Benchmark Pfandbriefe with maturities above seven years have dominated public placements since 2019. This coincides with the convergence towards negative territory of the average yield for Pfandbriefe across all maturity buckets. Along with a general flattening of the yield curve, this follows the resumption of the ECB’s asset-purchase programme in September 2019. Pfandbriefe yields widened at the start of the pandemic, but yields below zero remain the norm, fuelled by the pandemic emergency purchase programme initiated in March 2020.

The tenor of benchmark Pfandbriefe increased further in 2H20, and both factors dividing Pfandbriefe across the maturity spectrum remained established at the beginning of 2021.