German Pfandbriefe offer a significant yield pickup versus Bunds

Franz Rudolf

UniCredit Bank AG

08.2019

August 2019

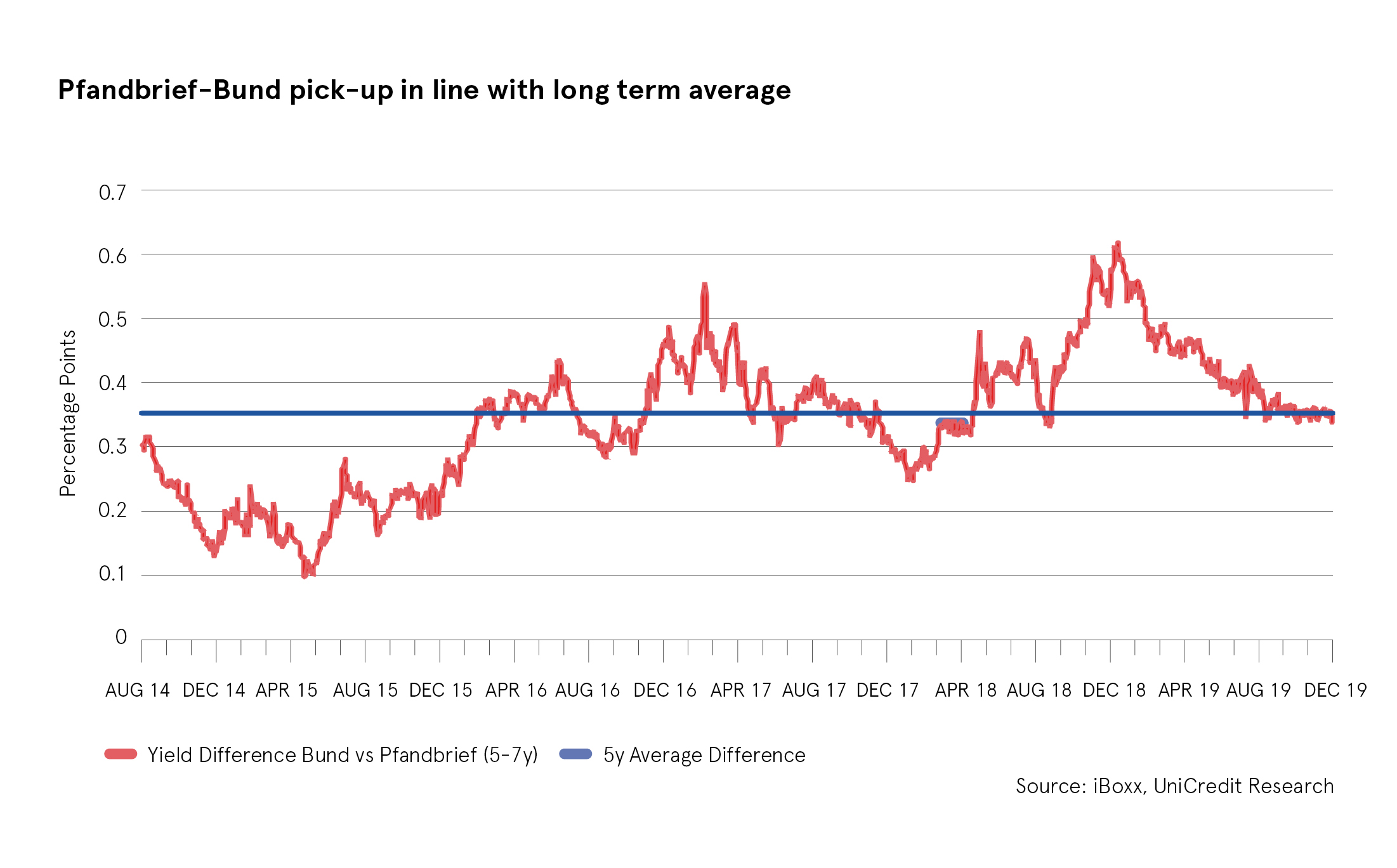

The yield difference between German Pfandbriefe (based on the iBoxx EUR Germany Covered 5-7) and German sovereign bonds (based on the iBoxx EUR Germany 5-7) is currently around 40bp (as of 8 August 2019). This compares to a 5Y average yield difference of 34bp. We chose the 5-7-year maturity bracket as this minimizes the mismatch in modified duration and therefore provides a better basis for comparison.

UniCredit Research expects the low-yield environment to continue at least throughout its YE20 forecast horizon. The rationale behind this is that with growth rates expected to remain modest in the euro area, inflation rates missing central bank targets and an accommodative ECB policy stance meeting high demand for safe assets due to global policy uncertainty, a pronounced U-turn towards higher yields remains unlikely.