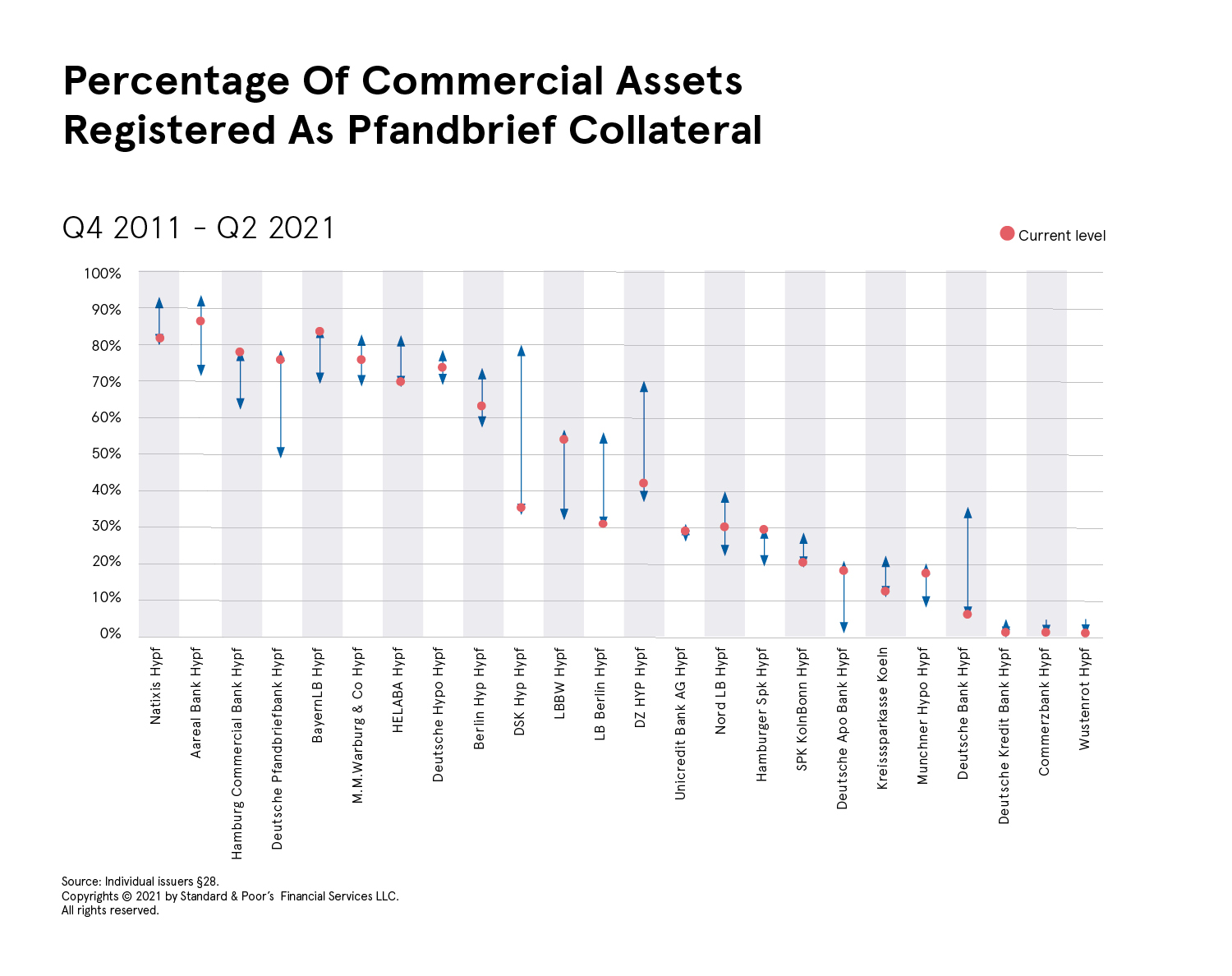

As shown in chart 1, the share of German assets backing Pfandbriefe varies across issuers. While most of them focus on assets sourced in Germany, some include mainly non-German assets in their cover pools.

chart 1

Our collateral support analysis is performed using the respective criteria for the underlying asset type, while our resolution regime and jurisdictional support analysis reflects the issuer’s jurisdiction.

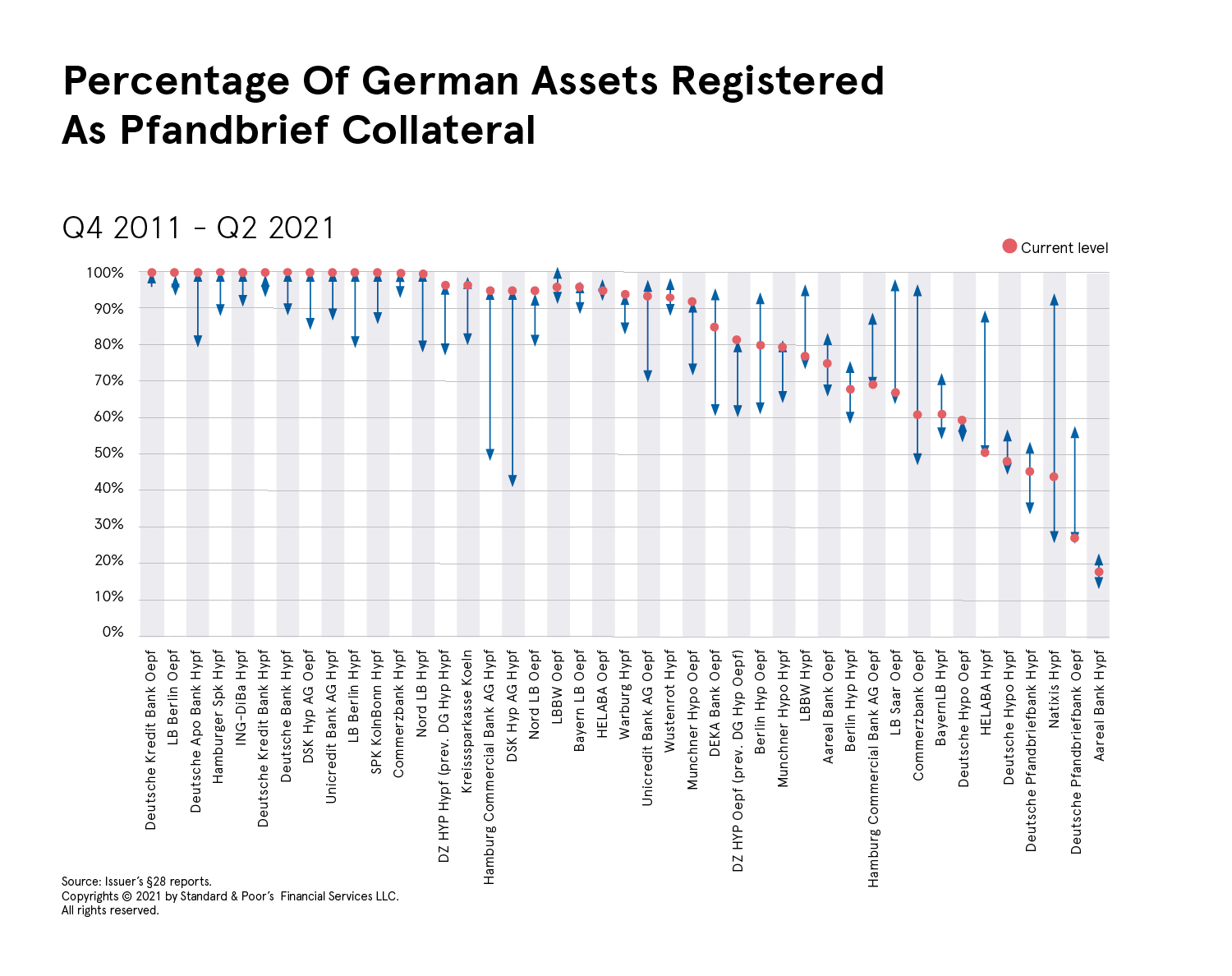

chart 2

As chart 2 shows the share of commercial assets also varies significantly across issuers. While we believe that commercial real estate asset performance may deteriorate, we do not anticipate this significantly impairing the credit quality of the German mortgage Pfandbriefe that we rate. This is because of the availability of credit enhancement to absorb losses.