2022 amendments to Pfandbrief Mortgage Lending Value regulation

Annett Wünsche

Association of German Pfandbrief Banks

Matthias Fischer

Association of German Pfandbrief Banks

01.2023

Significant changes and their impact on the determination of the Mortgage Lending Value

The amendment to the Mortgage Lending Value Regulation (Beleihungswertermittlungsverordnung, BelWertV) published on October 7, 2022 is part of the amendments package for secondary Pfandbrief regulation. The new BelWertV came into force on October 8, 2022. An exception to this are the regulations on monitoring the mortgage lending values (Article 26 BelWertV), which came into force on October 9, 2022.

Reasons for the amendment

The aim of the amendment was to align the BelWertV more closely with market developments in recent years. In recent years, the gaps between market values and mortgage lending values have been very large – caused in particular by the low interest rate environment – and for some properties the mortgage lending value amounted to less than half of the market value. With the amendment, a stronger adjustment to sustainable market conditions can now take place here – not quite as comprehensively as the banking industry would have liked, but it is a first step.

Winner private residential real estate financing

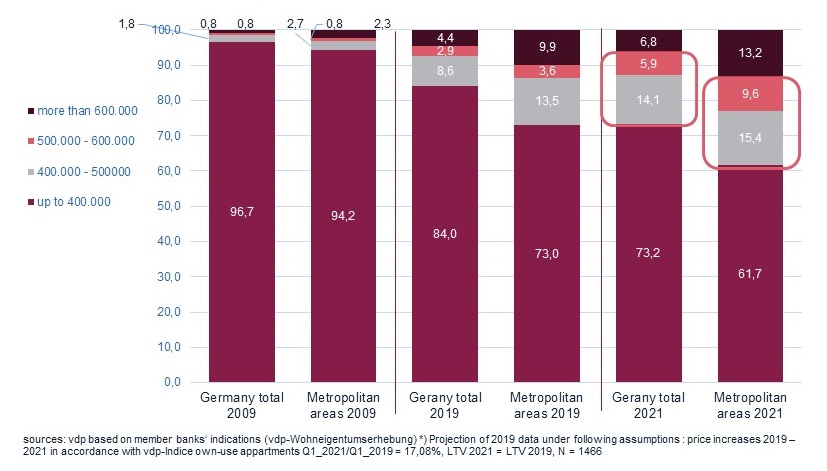

In our view, private housing finance will benefit most from the amendment by increasing the small loan limit to EUR 600,000, as a significantly higher proportion of loans to finance owner-occupied housing will fall under the provisions of Article 24 of the BelWertV.

Fig.1: Financings of owner-occupied housing by loan amount

Another significant adjustment to the BelWertV concerns the use of computer-assisted valuation methods: With the amendment, the use of statistical methods in the determination of the mortgage lending value in the comparative value method is anchored in the regulation for the first time. Its use relates to single-family and two-family houses as well as condominiums. This regulation is not linked to the small loan business and, in view of the standardization of real estate and data availability, should be of particular benefit to private residential real estate financing.

Income producing property

The new provisions of the BelWertV are less advantageous for properties for which the income approach is the value-determining method, i.e. commercial properties and multi-family houses. Significant changes include the determination of minimum capitalization rates for properties located in Germany by the supervisory authority and the minimum operating expenses.

Minimum capitalization rates to be linked to interest rate development

Instead of the previously applicable rigid minimum interest rates of 5 percent for residential and 6 percent for commercial properties, an at least partially dynamic model is to be used: Accordingly, the minimum capitalization interest rates will now be based on a fixed reference date1 on the interest rate of the 30-year federal bond, to which a risk premium of 3 percent for residential and 4 percent for commercial properties will be added. Upper and lower limits are provided for: Thus, the minimum cap rates – notwithstanding the surcharges for certain types of property (Annex 3 BelWertV) and the discounts for certain prime properties (Article 12 (5) BelWertV) – will always be between 3.5 percent and 5.5 percent for residential properties and between 4.5 percent and 6.5 percent for commercial properties (see Figure 2). The model for deriving the minimum interest rates only applies to properties located in Germany.

Fig.2: Domestic minimum cap rates according to new BelWertV

In principle, the dynamization of the minimum capitalization interest rates by linking them to the general interest rate development is to be welcomed. It takes up an important reason for the amendment: to improve the reflection of market conditions. However, in the view of the vdp, the model selected still has potential for optimization in the choice and design of the individual parameters.

It is to be welcomed that the possibility of reducing the minimum capitalization rates for first-class properties by 0.5 percent has also been extended to the residential and warehouse & logistics use types.

Operating expenses

Whereas the old version of the BelWertV stipulated that management costs, maintenance costs, the risk of loss of rent and a modernization risk to be applied depending on the property had to amount to a total of at least 15 percent of the annual gross income, the new regulation excludes the modernization risk and other non-allocable operating costs from the 15 percent minimum. In future, these two items must be added to the 15 percent minimum rate if they exist.

Conclusion

Overall, the adjustments made to the BelWertV lead to improved conditions, especially in private residential real estate finance. In the area of commercial real estate finance, the path taken with regard to minimum capitalization is the right one but remains to be thought through to the end: the model for interest derivation should be reviewed in light of the weaknesses identified and readjusted if necessary.

- footnotes:

- BaFin announced the minimum capitalization interest rates applicable from October 8, 2022 on its website on October 10, 2022. The decisive factor for determining the minimum capitalization interest rates is the yield of the 30-year federal bond on September 30, 2022: this was 2.08% (rounded up to 2.1%), so that, taking into account the risk premiums, a minimum capitalization interest rate of 5.1% results for properties with residential use and 6.1% for properties with commercial use, in each case plus any premiums to be taken into account for individual types of use in accordance with Annex 3 of the BelWertV. From now on, BaFin will review the interest rate on an annual basis on November 30: In the event of a change of at least 0.5 percentage points upwards or downwards in the yield of 30-year federal bonds published by the Bundesbank on this date compared with the beginning of the month preceding the last change in the minimum capitalization interest rates (currently: September 30, 2022), the minimum capitalization interest rates on January 1 of the following year will change by the corresponding percentage points rounded to the first decimal place in accordance with DIN 1333.