Why green Pfandbriefe are so popular with German banks

Sabrina Miehs

Landesbank Hessen-Thüringen

01.2024

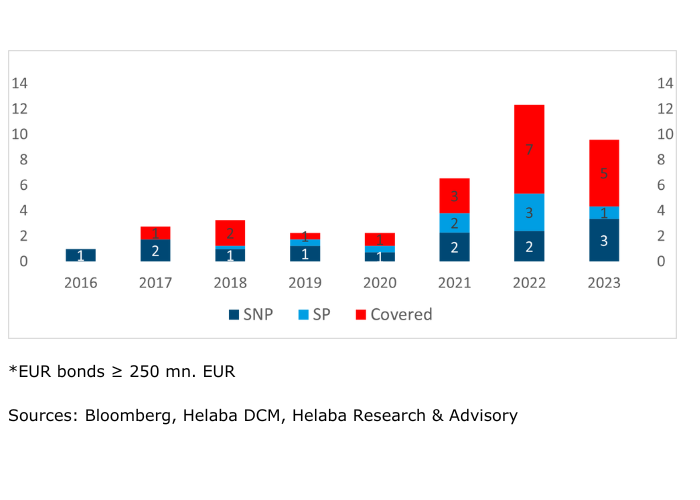

Green Pfandbriefe are very popular with German issuers. In 2022 and 2023, the issue volume of green Pfandbriefe from German institutions even significantly exceeded the total of senior preferred and senior non-preferred bonds placed in the green sub-benchmark and benchmark segment with EUR 6.75 billion and EUR 5.75 billion respectively.

Chart 1 Pfandbrief dominates green bank bonds from Germany

(Green bond issues in sub-benchmark and benchmark format* of German banks; EUR bn.)

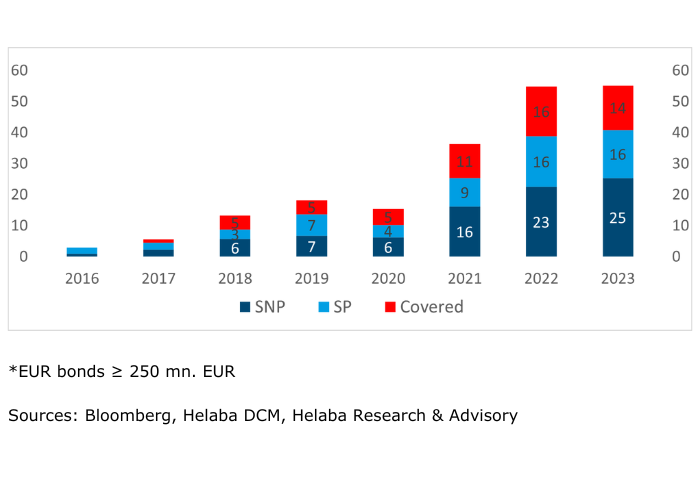

This development at German banks currently runs contrary to the European comparison: European banks clearly favour green senior non-preferred bonds for green refinancing. In 2022 and 2023, issuance of these securities reached a respectable volume of around EUR 23 billion and EUR 25 billion respectively, while issuance of green senior preferred bonds was significantly lower at around EUR 16 billion each and green covered bonds at EUR 14 billion (2022: EUR 16 billion).

Chart 2 Across Europe: senior non-preferred bonds first choice for green refinancing

(Green bond issues* of European banks including German banks; EUR bn.)

The fact that banks prefer to issue green bonds in senior unsecured markets i.e. green bonds with comparatively higher risk premiums, seems to make economic sense in view of a potential greenium. If investors are prepared to forego part of the risk premium due to the green character of the bonds, the higher the risk premium of the respective bond, the higher the greenium is likely to be when compared to a conventional bond with the same maturity (or this saving from the issuer’s perspective).

Back to the German banks and the question of why green Pfandbriefe are so popular as a green funding instrument.

Special features of the German banking market explain the high volume of green Pfandbriefe.

We assume that the following factors are the main drivers of the green Pfandbrief market:

– Historically, German Pfandbrief banks have been among the pioneers of green covered bonds in the banking sector, and this image has been reinforced to this day. As early as 2015, Berlin Hyp was the first institution to issue a Green Pfandbrief (later also in the senior unsecured segment), while Münchener Hyp even placed its first ESG Pfandbrief in 2014. More than ten issuers now issue Green Pfandbriefe. There is thus a certain amount of competitive pressure.

– There are also special features in the banking structure: the German banking market comprises several large mortgage banks whose most important refinancing instrument on the capital market is Pfandbriefe. These include the banks already mentioned and DZ HYP. The situation is similar with Wüstenrot Bausparkasse, which placed its first Green Pfandbrief in November 2023. The universal banks ING-DiBa and Unicredit Bank AG have so far only issued Green Pfandbriefe and have left refinancing by means of green senior non-preferred bonds to their group parent companies (ING Groep NV and Unicredit SpA).

– It is also conceivable that the establishment of their own minimum standards for Green Pfandbriefe by vdp member institutions in 2019 has given the market a boost that was only visible from 2021 onwards due to the usually long run-up period for debut issues. The support provided by the cooperation between vdp and consultancyal firm Drees & Sommer in proving the taxonomy allignment of financed existing buildings (through established top 15% benchmarking) is also likely to have made the decision in favour of green refinancing easier for some German players. In our opinion, the fact that Pfandbrief banks have issued Green Pfandbriefe on this scale in recent years speaks in favour of their deliberate pioneering spirit and/or the message they wish to send to the market: With its minimum standards, the Green Pfandbrief offers a reliable framework for issuers and investors and thus supports the sustainable transformation of the economy.

– In addition to Mortgage Pfandbriefe, Public Pfandbriefe can also be issued as Green Pfandbriefe. This was first seen in June 2022 with BayernLB, which used the bond to finance loans in the area of clean transport. Only a few European covered bond markets utilise the public sector covered bond segment, and if they do, then to a lesser extent than is usual in the German market. This possibility expands the potential for German banks to also finance asset classes of the public sector cover pool with a green character – and thus outside of property exposures – via Green Pfandbriefe.

– Last but not least, it should be noted that issues shown in the chart are limited to sub-benchmark and benchmark bonds, which contributes to the higher volume of green Pfandbriefe. If smaller lots of green senior unsecured bank bonds from German issuers were included, a different, economically more plausible picture would emerge, particularly due to the large number of small-volume, lower-cost private placements of green senior non-preferred securities by Landesbanks.