Covered bonds proved yet again the funding instrument of choice for banks under more volatile market circumstances.

In March, banks across the globe printed almost €20bn in EUR benchmark covered bonds, while primary markets stayed virtually closed in the unsecured segment post the Silicon Valley Bank fallout. This is quite an impressive print, considering that covered bond primary markets were also closed for two weeks in March. Half the issuance took place in the first week of March, but the other half was printed in the final week of the month. This illustrates the strong reopening of covered bond primary markets towards the end of March.

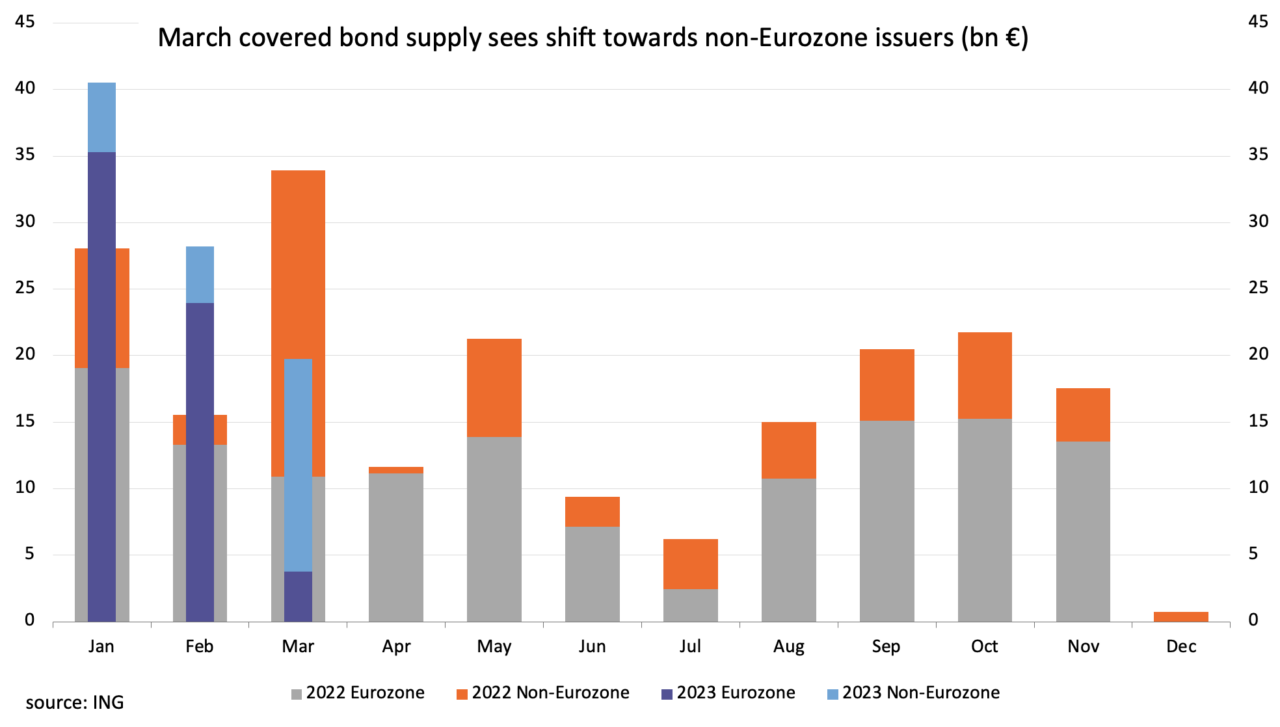

The supply dynamics did make a strong shift towards non-Eurozone banks. Non-Eurozone banks were responsible for 81% of the supply in March in comparison to 14% of the issuance in January and February. These banks probably stayed more side-lined during the first two months of the year to avoid the worst primary market crowd caused by Eurozone issuers. Many Eurozone banks eagerly rushed to the primary market in those months to still benefit from the presence of the CBPP3 in primary and the full CBPP3 reinvestments before the ECB started to phase these out in March.