Covered Bond Risk Scoring: Berenberg always has Germany in its top 3 countries

Philipp Jäger

Berenberg

11.2019

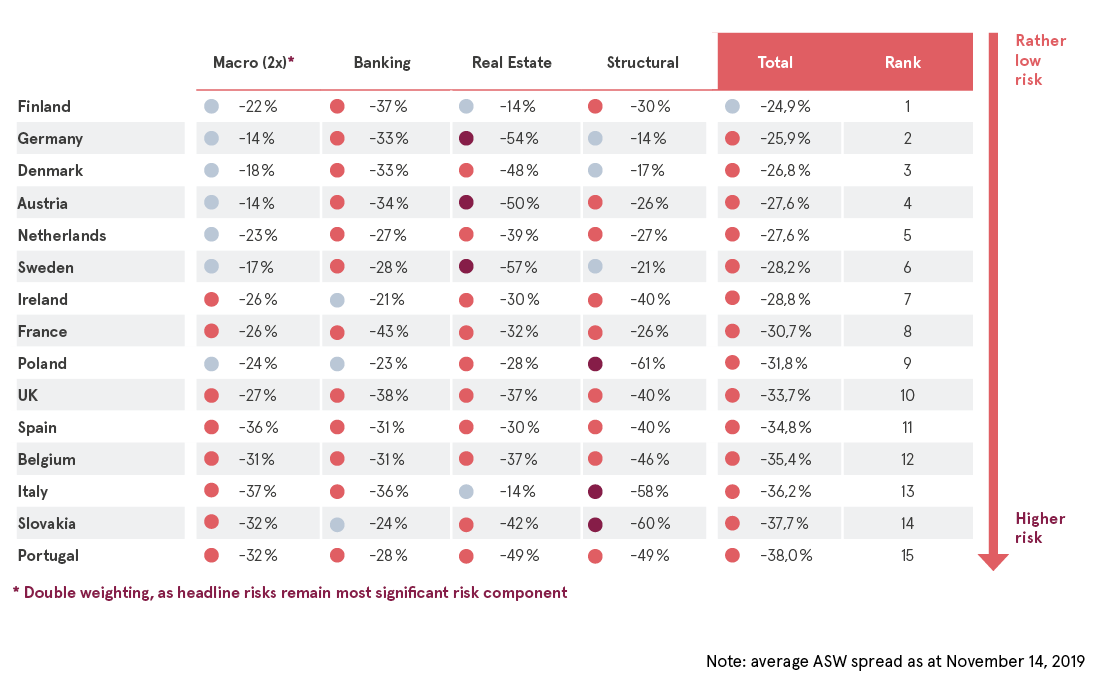

Once every quarter the analysts at Berenberg publish the results of their risk scoring model which they first introduced in 2014 and have consistently enhanced since then. Their model uses a systematic approach to measure external covered bond risks at the country level. Bond-specific risks such as the financial strength of individual issuers or the quality of the cover pools, on the other hand, are not taken into consideration. The risk scores that are calculated for 15 EU member states are based on a total of 39 factors from four risk categories: macroeconomic risks, general banking risks, real estate market risks as well as various structural factors of the respective covered bond markets.

The macroeconomic risks are derived, among other things, from metrics such as GDP growth, export dependence, labor market situation or household debt, whereas the analysis of general banking risks is based, for instance, on capitalization and the asset quality of the national banking systems. For the category of real estate market risks, reference is made, among other things, to classic measures for the identification of over- or under-valuations. On the other hand, various metrics which capture the significance of the national covered bond market, market liquidity, and the duration of insolvency proceedings as well as the fair and efficient enforcement of existing legislation feed into the risk category of structural factors. The individual variables are first translated into sub-scores ranging from 0 (no risk) to -10 (very high risk) and subsequently aggregated for each risk category and, finally, at the country level to arrive at an overall score (0%: no risk; -100%: very high risk). As a general rule, the scoring is of an absolute, not a relative nature. This means that the score in one category can be equally good or bad for all countries.

In the most recently calculated model (from November) the risk scoring result is as follows:

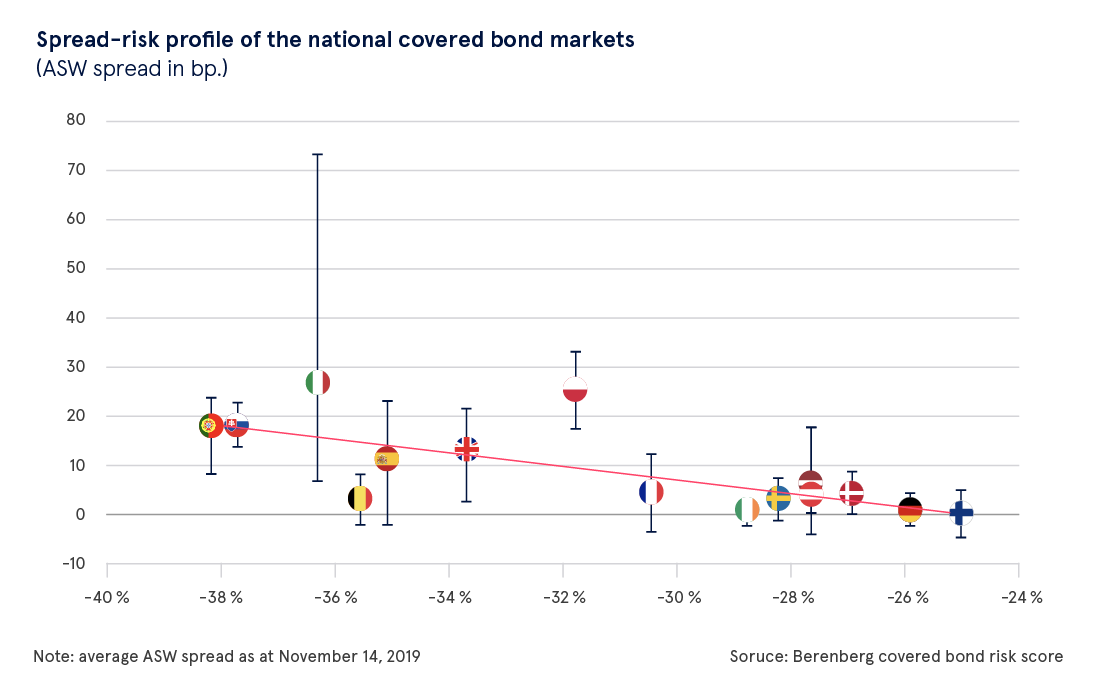

As in the previous quarter, the top positions are held by Finland, Germany and Denmark, although it should be said here that since the model was first calculated, Germany is the only country of these three that has always had a top three ranking. For Germany, especially low external risks are measured in the category of macroeconomic risks and structural factors. By contrast, Germany is in the middle of the table in terms of general banking risks, whereas in the case of real estate market risks, a significantly elevated risk is currently measured due to the rapid rise in prices. Real estate market risks – in particular, the possibility of contagion to the economy and the banking system – should on no account be underestimated. Nevertheless, in this respect one should abstract somewhat from the purely quantitative model output in Germany’s case. This is because the legal framework that is in place in Germany guarantees that certain real estate market risks for Pfandbrief investors are largely mitigated. The conservative valuation of a property under the Regulation on the Determination of the Mortgage Lending Value as well as the comparatively low loan-to-value ratio of 60% that is anchored in the Pfandbrief Act should provide Pfandbrief investors with adequate protection against losses in the Pfandbrief cover pools, even in the event of a trend reversal. This alone makes the Pfandbrief, for us, an enduring basic investment.