There are mainly technical reasons for the recent spread adjustments between individual countries. ECB and flood of issues shape the market.

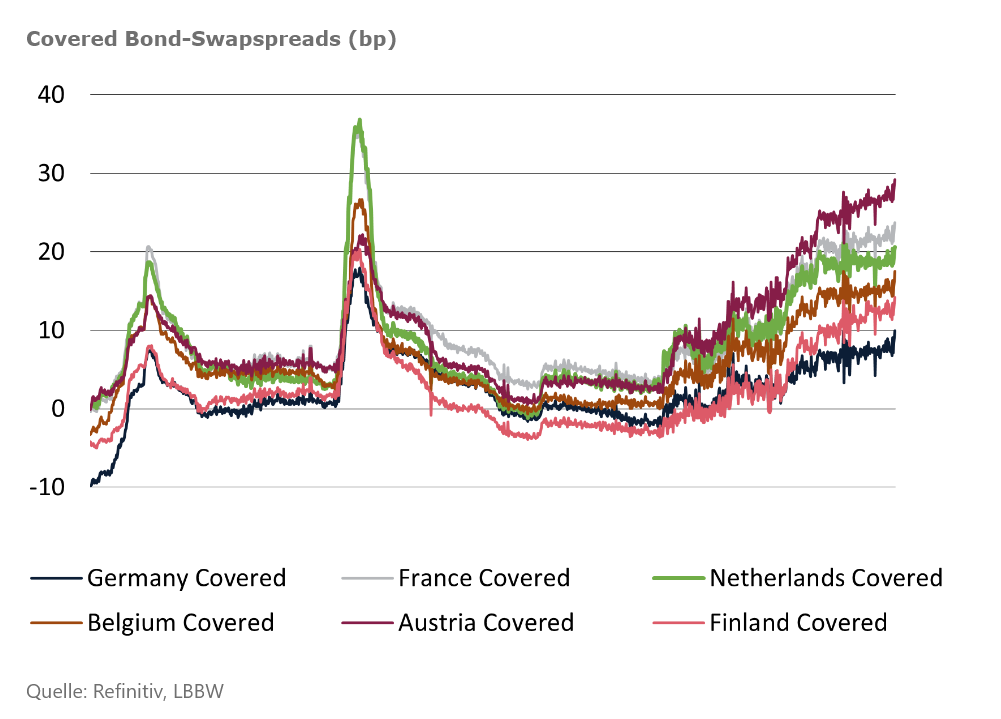

Spread widening and growing spread differences between the individual jurisdictions – not only in core European countries – are increasingly noticeable in the EUR covered bond market. After the spread differences to German Pfandbriefe for covered bonds from core Europe had been limited to a maximum of 5 basis points for a long time since mid-2020, this picture has been slowly but steadily changing since Q1 2022. Currently, the difference to French and Austrian bonds, for example, is 14 and 19 basis points, respectively – with generally rising spread levels for Pfandbriefe and covered bonds.

Therefore, there is talk of a “repricing” of these bonds. At first glance, this seems illogical. After all, the harmonisation of covered bond laws, which was finalised in July last year, led to an alignment of the individual legal frameworks and partly to structural improvements in individual countries. From this point of view, the differences have therefore not become greater, but rather smaller – and the asset class as a whole has thus become even more attractive for investors.

The beginning of the spread widening coincides with the interest rate turnaround of the ECB, which as is known has adjusted its key interest rates step by step to a completely different level from the middle of 2022 and thus created a new yield environment. This brought new (old) investor groups back to the covered bond market. Thus, increasing shares of new issues are being bought by asset managers, while the ECB withdrew completely from primary market purchases as of March. This, too, led to increasing risk differentiation between individual countries. The central bank’s purchases on the primary market, which started again in November 2019, had demonstrably reduced the spread differences between individual countries in our view.

In addition, the EUR covered bond primary market is experiencing a veritable flood of new issues this year, partly in light of the TLTRO III refinancing. At currently EUR 136 billion, even the previous year and thus the strongest issuance year in history is being eclipsed.

This has several effects on pricing in the market. In general, new issues create new liquid price points to which other bonds on the secondary market then adjust. This is particularly true for jurisdictions that have been rarely seen in recent years, such as Portugal or Italy, but which have recently re-opened. Another factor is that the demand for new bonds has waned given the sheer volume of new issuance year to date. New deals must therefore be brought to the market at higher premiums, which creates pressure and leads to repricing in the secondary market.

In our view, the ongoing rate uncertainty should not be ignored. Against this background, we believe that a selective approach to new issues is once again appropriate with regard to the choice of maturities and the (pre-) limitation of issue size and spread range.

In general, however, it should be noted that spread differentiation for covered bonds is still at a comparatively low level, despite numerous trouble spots. The basis for this is the mostly stable outlook of the issuing institutions. We also see only limited pressure from the latest signs of crisis on the real estate markets. Legal regulations regarding the composition of the cover pool as well as overcollateralisation requirements provide certain stability here. With a view to LTV limits and partly conservative valuation methods, substantial buffers against cyclical price declines have built up in recent years.