Covered bond market review and outlook for 2020

Karsten Rühlmann

Landesbank Baden-Württemberg

12.2019

2019 was characterized by a strong primary market and declining yields for covered bonds. Political uncertainty was unable to put a dent in the broader market, as stable risk premiums indicated. As the year drew to a close, the ECB resumed new net purchases, resulting in new shifts in the investor base. Below, we review the past 12 months and look ahead to 2020.

Strong primary market in 2019

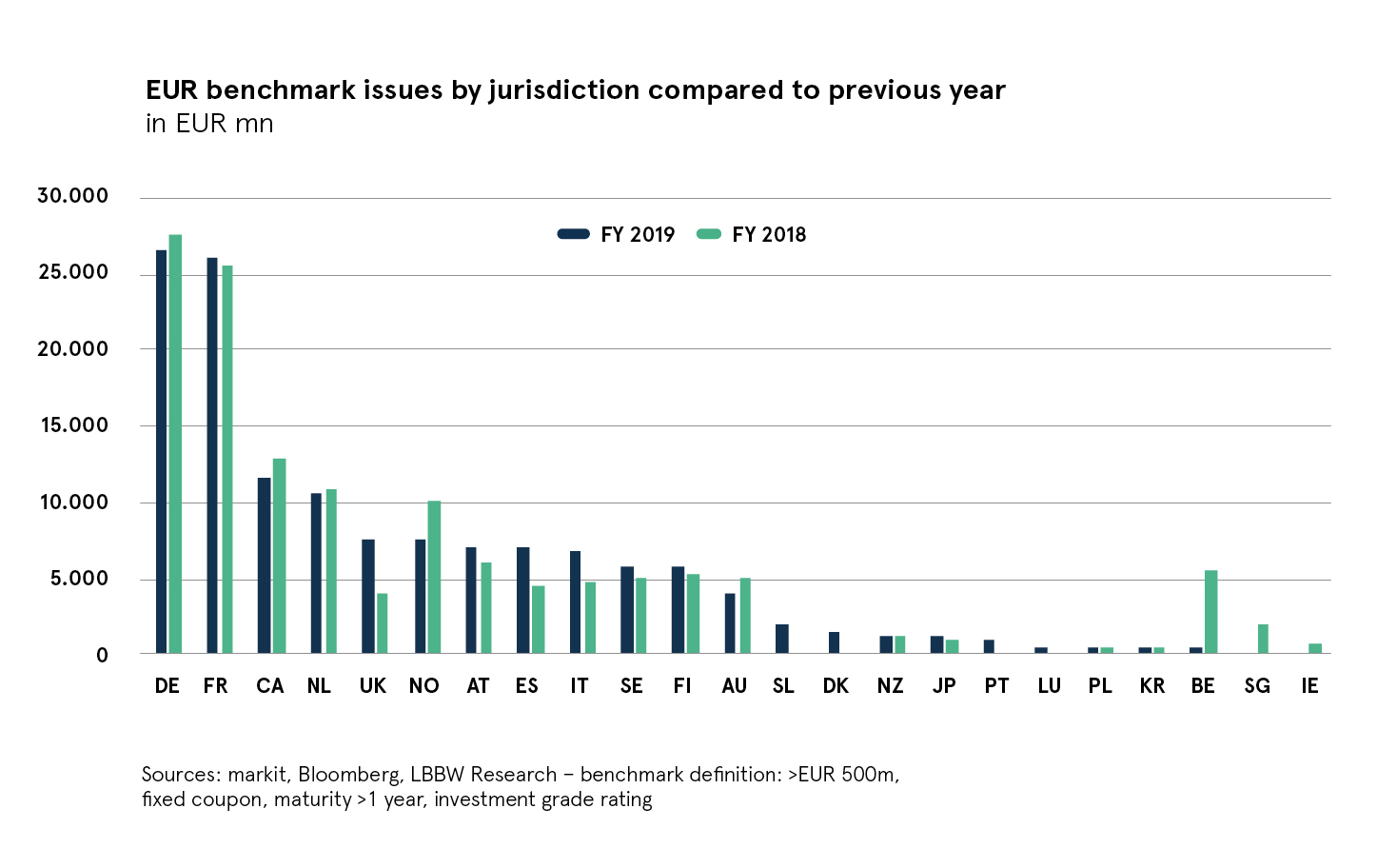

This has been a relatively busy year for the primary market, with covered bond benchmark issuance (excluding taps) at EUR 135bn. Over the past five-year period, only 2015 had higher issuance: EUR 141.5bn in total. Issuance increased nearly 2% over the year before, which was also very strong (2018: EUR 132.7bn). Since EUR 102bn in benchmarks matured in 2019, the positive net new issuance was EUR 33bn. All told, 104 issuers from 21 jurisdictions entered the market via 170 issues.

Over two thirds of the issues, or EUR 92.2bn, were placed in the first half of the year. Issuance was highest in January (EUR 37.3bn), followed by February (EUR 12.9bn) and September (EUR 12.5bn).

German and French issuers lead the pack

Looking at the countries, Germany issuers came in just ahead of French institutions, both in terms of the volume (EUR 26.5bn vs. EUR 26.0bn) and number of EUR benchmark bonds issued (40 vs. 28). Canadian issuers were once again highly active this year and placed a total of ten issues totaling EUR 11.5bn. High issuance (EUR 10.5bn) in the Netherlands benefited largely from (jumbo) issues from three large banks: Rabobank (EUR 4.0bn, 3 jumbos), ING (EUR 2.0bn, 1 jumbo) and ABN Amro (EUR 1.5bn). All told, they account for EUR 7.5bn in issuance. Issuance from Nordic banks stayed relatively unchanged from prior-year levels at EUR 20.5bn, with Norwegian issuers once again accounting for the largest share, EUR 7.5bn. Next in line were Finland and Sweden, which each issued EUR 5.75bn. Denmark entered the EUR benchmark segment once again this year, issuing EUR 1.5bn. Institutions from the UK and Italy brushed off Brexit turmoil and political uncertainty and floated EUR 7.6bn and EUR 6.9bn, respectively. Austria also cut a good figure with EUR 7.0bn in EUR benchmark issuance.

10 debuts

Several institutions entered the market for the first time in 2019. There were ten debuts in total: Volksbank Wien, VUB, Danmarks Skribskredit, Abanca, Slovenska Sporitelna, Axa Home Loan SFH, Virgin Money, Liberbank, Primabanka and Raiffeisen Bank International.

This year, the EUR benchmark segment contained no issuers from Ireland or Singapore. Belgian institutions also fell short of our expectations, issuing only one benchmark bond.

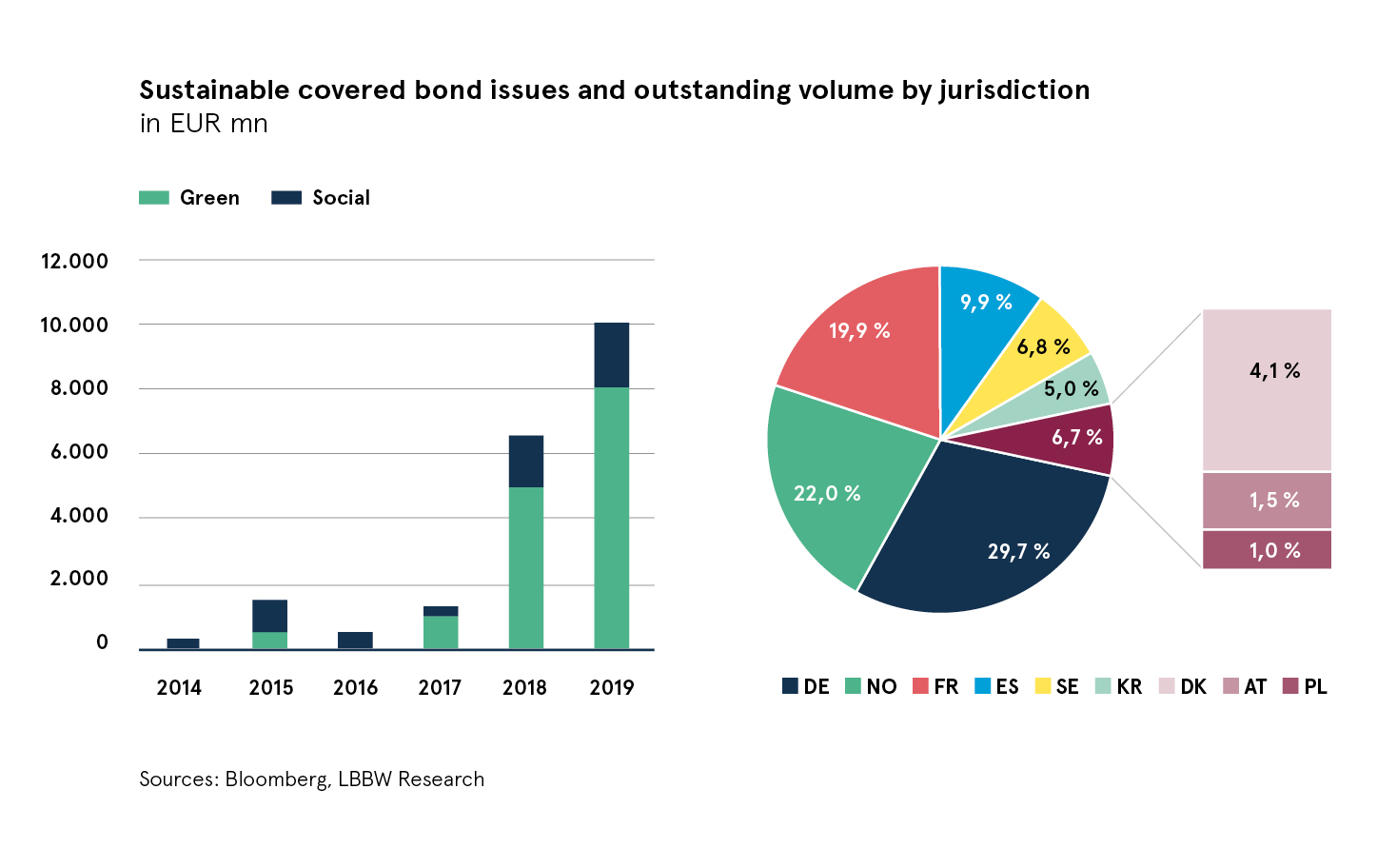

Sustainable covered bonds are gaining more momentum

The market for sustainable covered bonds gained more momentum in 2019, reaching EUR 10bn in total. The EUR benchmark segment alone accounted for EUR 6.5bn in bonds. That puts the global outstanding volume of covered bonds backed by sustainable assets at EUR 19.8bn. There are 22 issuers from nine jurisdictions. Green covered bonds are dominant, accounting for more than 70% of the market. Nearly 30% of issuance is attributable to issuers in Germany, followed by Norway (22%), France (20%) and Spain (10%).

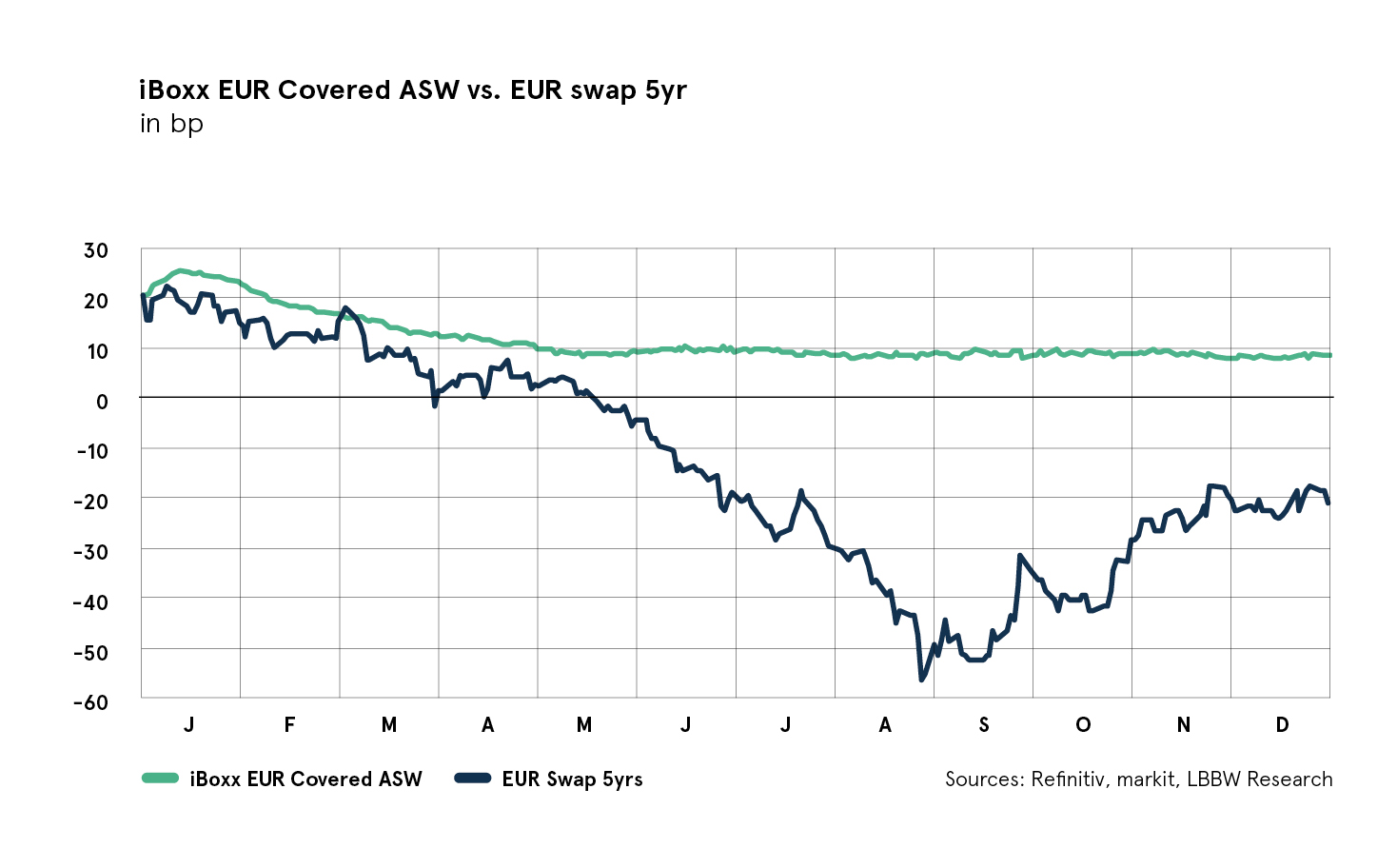

Negative yields overshadow second half of 2019

At the end of 2018, investors still harbored hopes that interest rates would increase. These hopes were dashed in mid-January. Yields plummeted as a result of the ECB’s continued monetary easing. The trend was largely driven by declining EUR swaps. For example, the 5-year swap dropped approx. 75 bp to its low. In contrast, risk premiums – as measured by the iBoxx EUR Covered – narrowed a mere 18 bp until May, only to stay flat for the rest of the year. At the low point in August, over 95% of all bonds listed in the iBoxx EUR Covered carried negative yields. The environment has since improved slightly; now, only more than 75% of the yields are negative. The primary market also witnessed negative yields in the second half of 2019. All told, 26 of the 51 EUR benchmark bonds issued after the summer break carried negative issue yields. The market absorbed all of them more or less gracefully. However, the order books were less granular in the second half of 2019 than the first.

ECB back to net purchasing since end of year

The ECB did more than change interest rates this year. By resuming net purchases under the Asset Purchase Program (APP) in November, the ECB has become more actively and directly involved in markets by buying covered bonds under the CBPP3. It has chosen to focus its efforts on the primary market, which was immediately reflected in the investor distribution of EUR benchmark transactions. During the year, “Central Banks/Official Institutions” accounted for 17% of transactions on average. However, in November, their share spiked to 28%.

Expectations for 2020

- We thus expect the ECB to be a determining factor that will affect the covered bond market in a wide variety of ways in 2020. First and foremost: The ECB is resuming net purchases under the APP in the amount of EUR 20bn per month. We assume that the CBPP3 will account for 8% to 10%, or EUR 1.5bn to EUR 2.0bn, of net purchases. If this amount is added to reinvestments of bonds maturing in 2020, which will likely rise to at least EUR 33bn in total, the gross purchases will likely work out to around EUR 55bn. This is double the volume of covered bonds bought in 2019. With an expected volume of more than EUR 90 billion of EUR benchmark covered bonds eligible for CBPP3 purchase next year, the ECB’s importance as an investor will increase significantly. Particularly since the introduction of tiering and stubbornly low interest rates will push some investors out of the covered bond market.

- We assume that interest rates will remain low in 2020. Negative (secondary market) yields will continue to predominate. The deposit rate will probably be cut another 10 bp to -0.60%, according to our economists. As investors leave the market and issuance-heavy months come around, risk premiums could come under upward pressure. However, this will likely be countered by strong demand from the ECB. All in all, we expect spreads to remain flat.

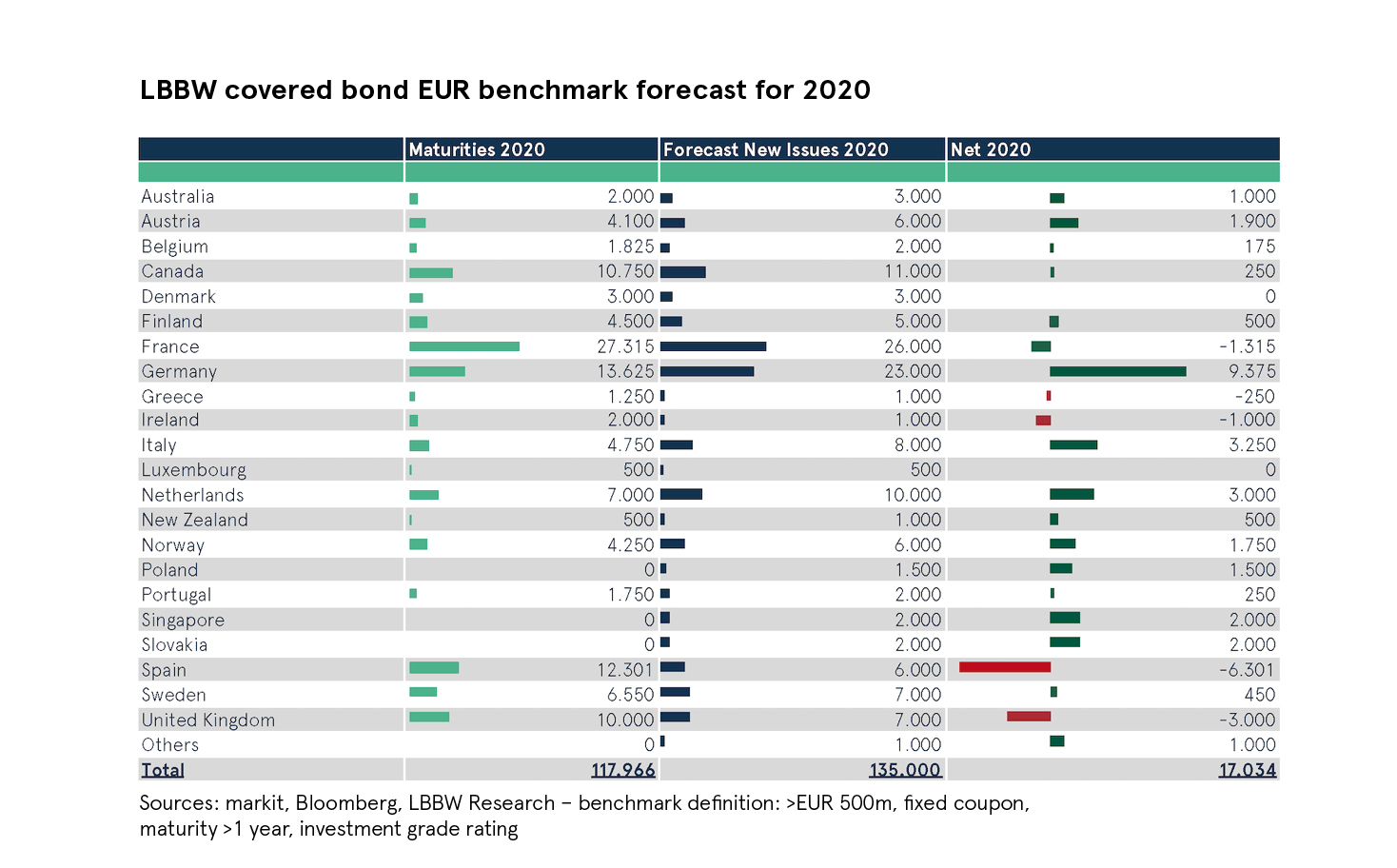

- The primary market for EUR benchmarks will probably be strong in 2020 as well. We expect issuance to be on par with 2019 levels at EUR 135bn. Since benchmark maturities will be EUR 118bn, positive net new issuance could be EUR 17bn. French and German issuers will probably lead the pack again at EUR 26.0bn and EUR 23.0bn, respectively. Issuance will likely be boosted by strong demand from the ECB, rising maturities, continued credit growth and issues from new issuers and jurisdictions. High TLTRO II maturities (2020: EUR 435bn) could also encourage peripheral issuers in particular to return to the covered bond market in greater numbers. However, the next inexpensive refinancing option is already available: the TLRTO III. Issuance could be reduced by factors such as macroeconomic and political uncertainty that closes issuance windows. There is also some forecast uncertainty surrounding non-EUR jurisdictions, which could decide to issue bonds denominated in their home currency or other alternative currencies in this negative-yield environment.

- We expect continued growth in the market for sustainable covered bonds in the form of green and social covered bonds in 2020. EU regulatory initiatives as well as national initiatives – such as the vdp’s minimum standards for Green Pfandbriefe – will help the sustainable segment pick up further momentum. We expect issuance to rise from EUR 10bn in 2019 to EUR 15bn in 2020.

- The EU completed the process of passing legislation on covered bond harmonization in 2019. In 2020, it will be the national legislatures’ turn to translate the new rules into national covered bond laws. They have 18 months to do so. The laws have to take effect no later than 30 months after the new directive enters into force – i.e. no later than mid-2022. In the months ahead, jurisdictions that need to make sweeping changes – such as Spain – will likely engage in lively debate on how to transpose the provisions of the new Covered Bond Directive into their own covered bond legislation.

The following summary contains the detailed EUR benchmark forecasts for 2020.